How To Withdraw From Kwsp

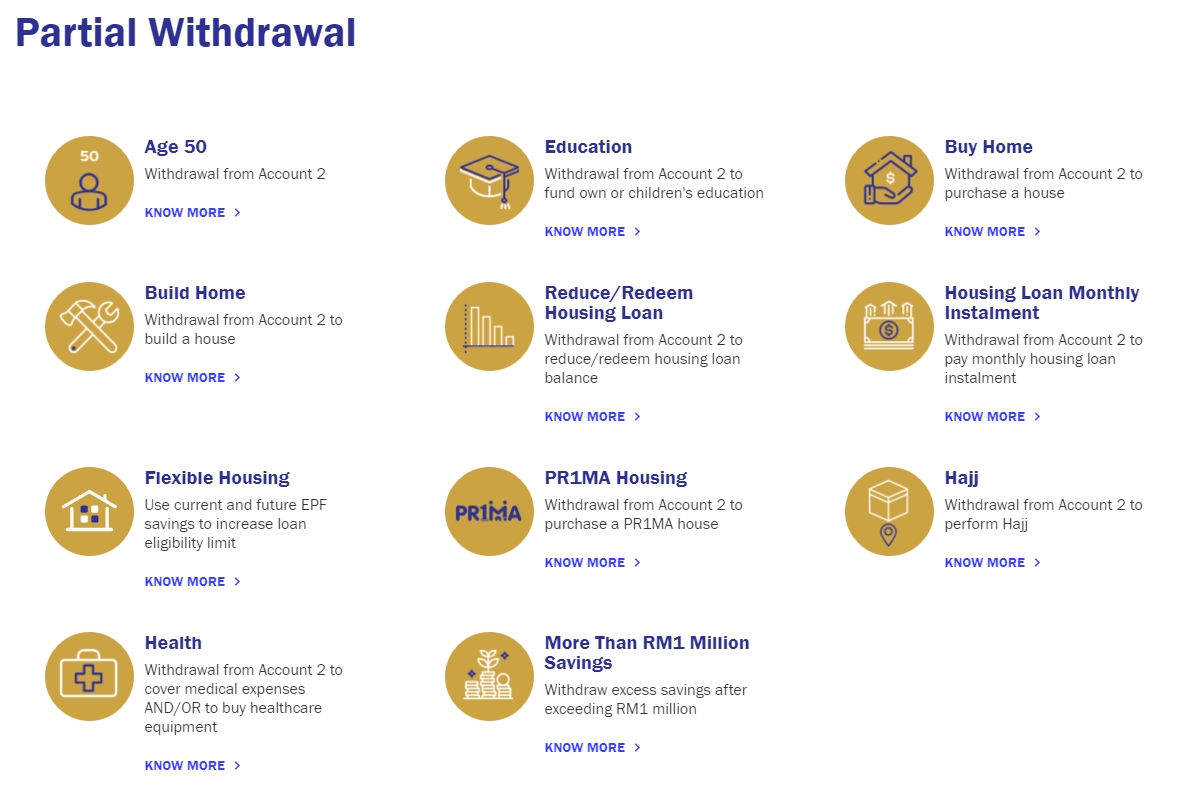

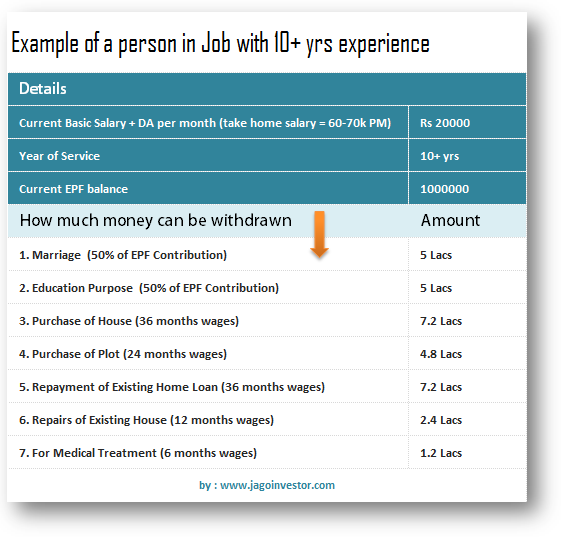

When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. Members can now withdraw up to RM10000 if they have less than RM90000 in Account 1.

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

Form KWSP 3 Pindaan for mail submissionsfailed thumbprint verification.

How to withdraw from kwsp. Note that the amount applied and approved for is fixed and cannot be changed. For applications after April 2020 withdrawal payment will be made from the date the withdrawal application is received by the EPF. Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account.

Applications will begin from mid-December 2020 and the money will be paid out starting 1 month after the application is approved. In most cases it would mean that you will have to pay for the following upfront costs first and complete the following before applying for a withdrawal. You can apply for withdrawal through i-Akaun.

Generally you will have to pay for the following costs upfront and complete the following forms before applying for a withdrawal. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime.

On April 14 EPF launched a dedicated website specifically for withdrawals under the i-Lestari programme. However if youre unable to apply online you can also apply for i-Lestari such as through emailing email protected or posting your physical application to the address below. How To Withdraw EPF Money Reaching 50 Years Old When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2.

This is the most common form of EPF withdrawal. Down payment for the house. If you do not have an account you may need to first get yourself registered with one at your nearest EPF kiosk or counter.

If you plan to apply for the i-Sinar program do stay tuned to the official announcement by EPF on their website and follow them on Facebook. The EPF does not appoint any third party to handle KWSP withdrawals and all online applications must be made directly through their app or portal. Please DO NOT refer to the submission information in Employees Provident Fund KWSP website.

Follow through the steps for i-Akaun activation and your account will be ready for withdrawal. Haj withdrawals helps members finance basic expenses of the Haj with a limit of RM3000. If the member has made a nomination during his or her lifetime the named nominee would need to apply for this withdrawal provided that the nominee.

Now EPF members can easily apply for the i-Lestari withdrawals via the website ilestarikwspgovmy. You can walk in to any KWSP office to submit the KWSP 9C AHL D5 Withdrawal Form along with the supporting documents or submit via postal services.

Form KWSP 9C AHL and Checklist. KWSP will advance RM1000 to members who apply for withdrawal from January 26 The i-sinar program with features which enable you to withdraw RM10000 and not more than Rm100000 According to the information released by the Employees Provident Fund KWSP in order to help members obtain their own provident fund deposits as soon as possible the Provident Fund has. Then you need to activate your account within 30 days via wwwkwspgovmy by logging in as members.

For withdrawal applications received in April 2020 payment will be credited in May 2020. Once this is done you will be given a temporary username and password. Age 505560 Withdrawal.

Lawyer fees and stamp duty for the Sale and Purchase Agreement. 81 rows i-Lestari Online portal on the EPF website at wwwkwspgovmy. If your application is approved in April you can withdraw for a total of 12 months April 2020 March 2021.

However if your application is approved in September you can only withdraw for 7 months September 2020 March 2021. The basics youll need include filling out the withdrawal form KWSP 9C AHL D5 which can be done online or downloaded and filled manually a copy of your Identification Card and bank statement as well as the Sale and Purchase agreement for the property in question. Members can also check their application status using this new facility.

Every citizen is advised to apply online to avoid delays in processing your application and withdrawal. There are several ways to apply. Kumpulan Wang Simpanan Pekerja Karung Berkunci No 220.

Booking fee Down payment for the house.

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

I Lestari How To Withdraw Rm500 Month From Your Epf Account

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

I Lestari Here S An Easier Way To Withdraw Rm500 From Epf Without Forms

I Lestari How To Withdraw Rm500 Month From Your Epf Account

I Lestari Here S An Easier Way To Withdraw Rm500 From Epf Without Forms

Thinking Of Withdrawing From Your Epf Account 1 Here S What You Should Know Before You Do It News Rojak Daily

How To Withdraw From Your Epf Account To Buy A Home

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Posting Komentar untuk "How To Withdraw From Kwsp"