How To Withdraw Money From Epf At Age 50

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and. You can withdraw 90 of EPF balance once you reach the age of 57 years.

Epf Withdrawals Will Affect Future Of Retirement

In such a case the monthly pension received at the age of 50 years of age will be lower than the pension that an individual will be eligible for at the age of 58 years of age explains Gupta.

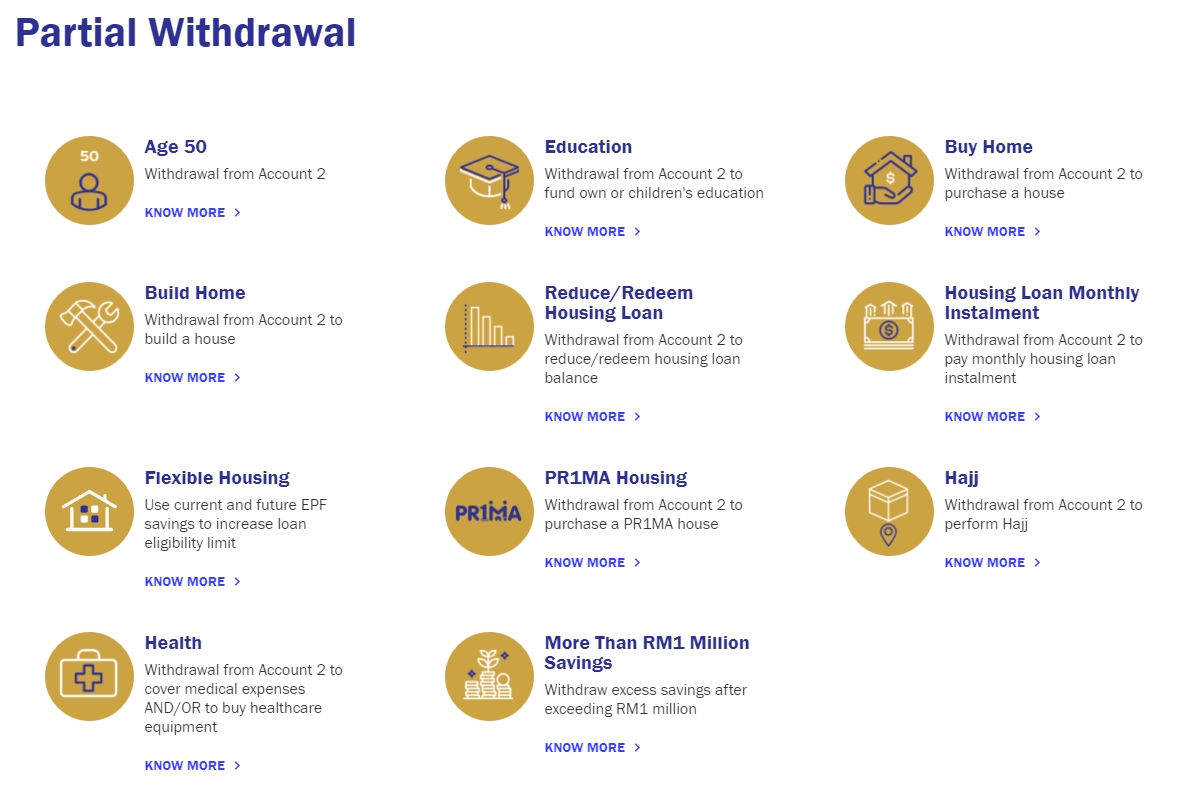

How to withdraw money from epf at age 50. You can not withdraw an Employers contribution to EPF before 58 years An individual can not withdraw the EPF contribution by the employer before the retirement age of 58 years. EPF withdrawal at age 50. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

The amended rules do not allow. For more details on types of withdrawal and how to go about checking their website is highly recommended. However there is no clarity in the income tax laws under which head it is taxable What if you have withdrawn money from EPF.

There is no minimum withdrawal amount required. When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2. EPS Form 10C however can be used to withdraw the accumulated pension amount after a continuous service of 180 days and before the completion of 10 years of active service.

Ways to Withdraw PF Amount Although withdrawal of PF isnt allowed while you are still employed there are ways to get this amount in case you need it badly. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. Members may opt for full or partial withdrawal.

The withdrawals from the EPF within 5 years of joining are still taxable. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. If yes you can proceed with the following steps.

I will be 50 soon. Is the withdrawal from EPS taxable. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time.

Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends. 867 Views Asked 10 Years Ago. All applications for withdrawal must be made one month prior to reaching the age of 55 as members will only be paid once they have reached that age.

An EPFO member can withdraw upto 90 of the EPF amount at any time after attaining of the age of 54 years or within one year of his actual retirement on superannuation whichever is later. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. You can apply for withdrawal.

The EPF has a list of approved banks for you to bank in. The proposed new withdrawal rules will be implemented from 1st Aug 2016. A physically handicapped member can withdraw from his EPF kitty for purchasing equipment required to minimize his hardships.

90 of the EPF balance can be withdrawn after the age of 54 years. EPF withdrawals are available for eligible members who are Malaysian citizens or non-Malaysian citizens residing in Malaysia who have an EPF account but they must be between 55 and 59-years old and hold their savings in Account 55. How To Withdraw EPF Money Reaching 50 Years Old.

You can make this withdrawal in case you have switched your job and do not want to get yo. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2. Asked on Sep 7 2010 at 2115 by.

Hello Below are the key takeaways from the latest press-release released by the Ministry of Labour Employment regarding EPF withdraw. Pension is to be paid from age. Now you can withdraw all your EPF at age 55 while you are still working with someone else if you choose to retire at later years say at age 60.

However you may voluntarily choose not to withdraw your retirement fund at KWSP if you dont need that. Visit the EPFIndia online portal and in the main Services tab choose For Employees You will be taken to the Member Homepage. Form 10D Form 10D is the general form that a member needs to fill to withdraw monthly pension after the age of 50 years.

Here are the main amendments to EPF withdrawal rules-. A member can withdraw the full amount from their Akaun 2 when they turn 50. Kasturirangan says Any lump sum withdrawal from the EPS account will be taxable.

Please DO NOT refer to the submission information in Employees Provident Fund KWSP website. If you have already completed 10 years of service the EPS amount cannot be withdrawn and only the scheme certificate is to be issued by filling Form 10C along with the Composite Claim Form Aadhaar or Non-Aadhaar. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Withdraw via i-Akaun plan ahead for your retirement. Age 50 withdrawal. Online withdrawal of funds in the EPF account is only possible if the above conditions are met.

As long as you bank your EPF money into a bank which you owe no debt it is safe.

Epf Withdrawal From Account 1 2 What Can They Do For You

I Lestari How To Withdraw Rm500 Month From Your Epf Account

Epf Withdrawal From Account 1 2 What Can They Do For You

Kwsp Epf Partial Withdrawal Age 50

Pf Withdrawal Eps Withdrawal How To Withdraw Pf And Eps Money After Leaving Your Job

How To Withdraw Money From Epf Emplyee Provident Fund Login Account Withdraw Money From Your Epf Account And All The Details Related To Epf Money Withdrawal

Epf Withdrawals For Those Aged 50 55 And 60 I Akaun Activation To Resume Wednesday Malaysia Malay Mail

Pf Withdrawal After Leaving Job How To Apply

No Cash For Investment You Can Withdraw Money From Your Epf Savings To Increase Saving For Retirement Members Can Invest 30 Of The Total Savings From Account 1 Into Investment Schemes Approved

Posting Komentar untuk "How To Withdraw Money From Epf At Age 50"