I-sinar Withdrawal Form

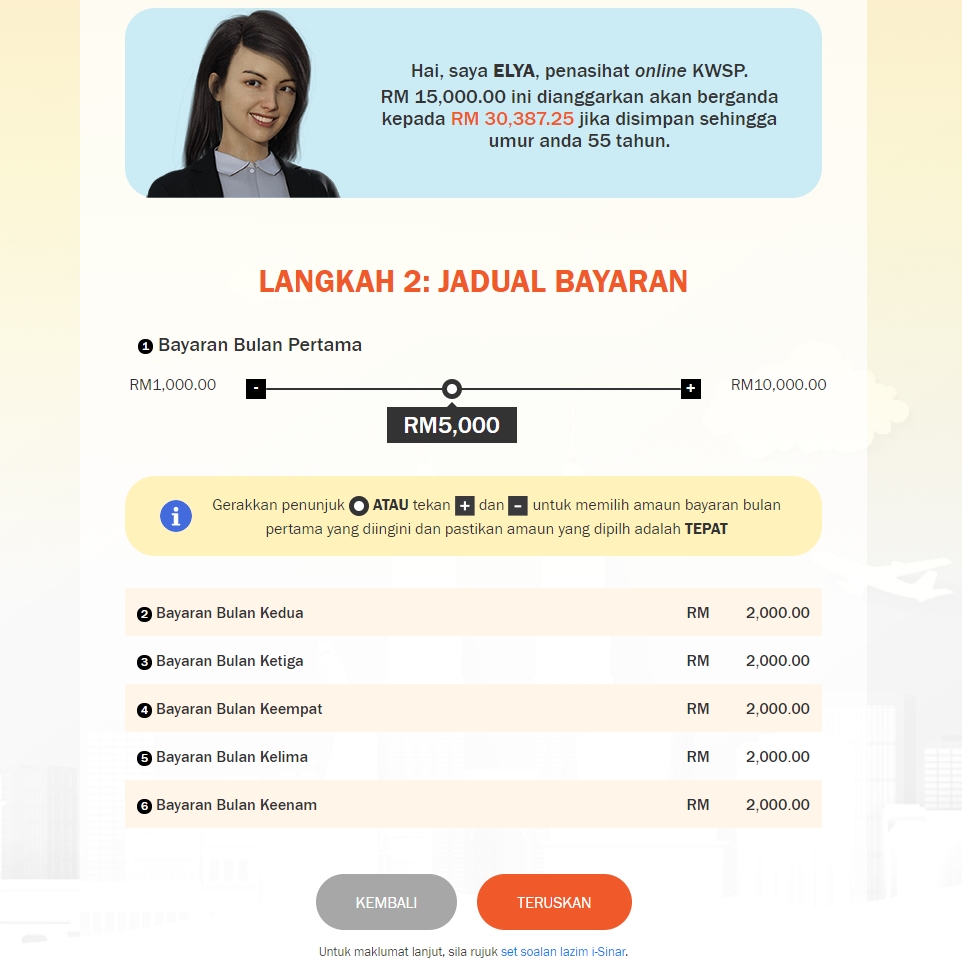

The removal of the i-Sinar criteria will also mean that the interim payment of RM1000 implemented last month will be effectively stopped. Applications will begin from mid-December 2020 and the money will be paid out starting 1 month after the application is approved.

I Sinar A Rm56bil Question Mark The Star

After going through much debate both among the Malaysian public and within Parliament the Employees Provident Fund EPF has finally released the finalised details on its much-awaited i-Sinar Akaun 1 withdrawal facilityFrom how to apply to how much money you can withdraw here are some frequently asked questions and their.

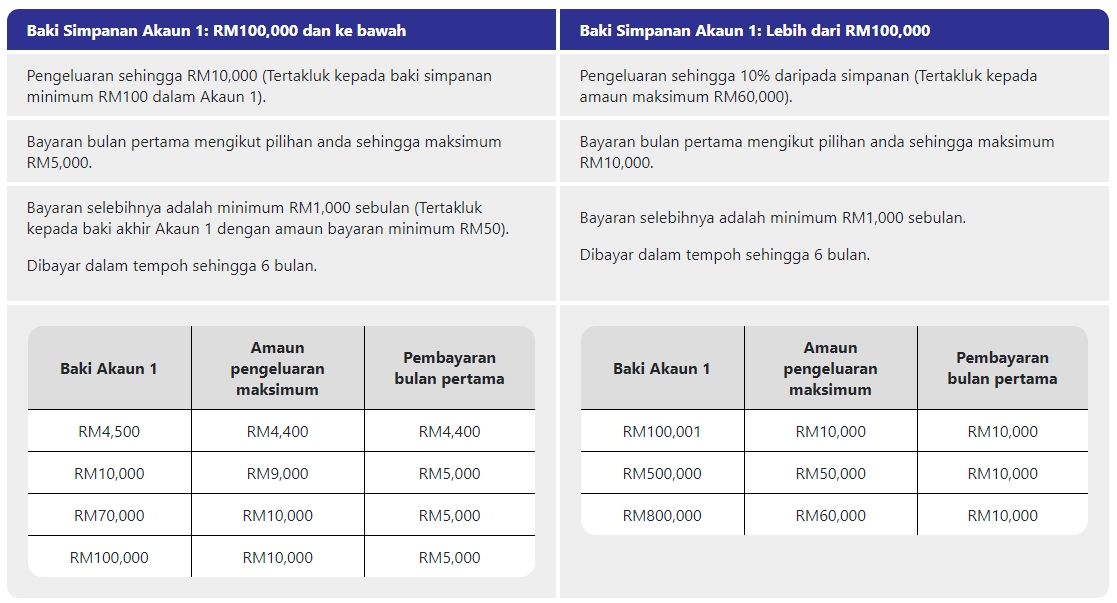

I-sinar withdrawal form. Category 1 members have been able to submit their applications since Dec 1 2020 while members under Category 2 can start applying today. The i-Sinar withdrawal will be paid out across a period of 6 months. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000.

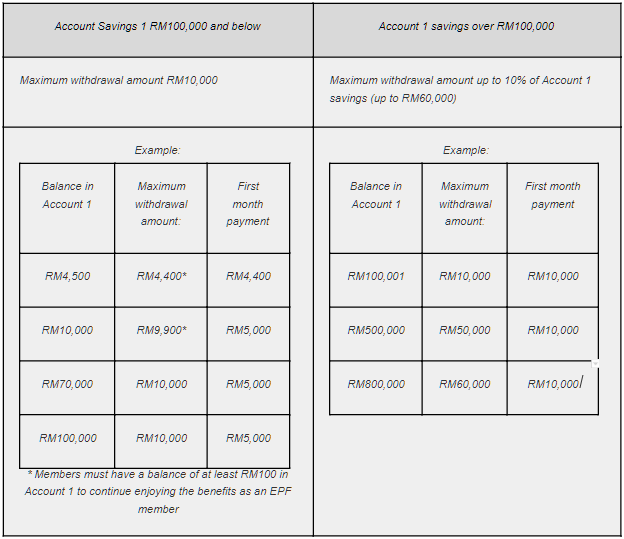

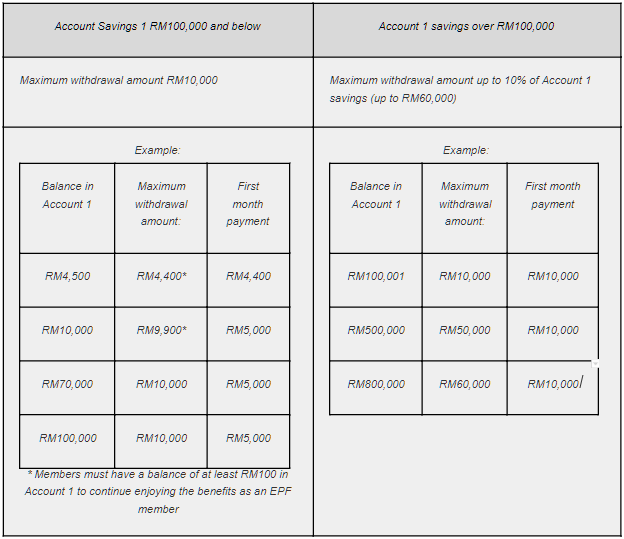

If your partner parents or guardians have been giving you physical mental or financial abuse then use the EPF i-Sinar money to save yourself. The payments will also be staggered over a period of six months with a first payment of up to RM10000. For those with more than RM100000 may withdraw up to 10 of their account balance with a maximum cap of RM60000.

However the maximum total amount withdrawal allowed is RM60000. Do note that you are only allowed to make the amendment once. Despite the convenience offered the facility is not a withdrawal or a form of free cash because EPF members still need to replace the funds later.

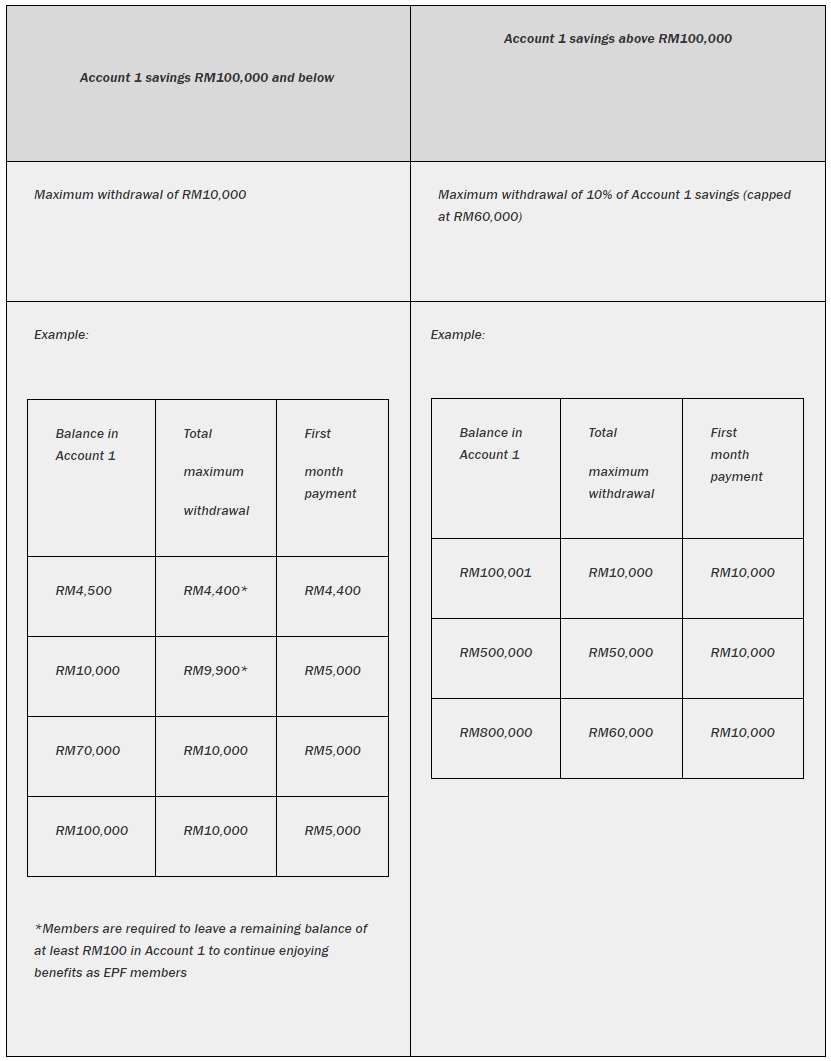

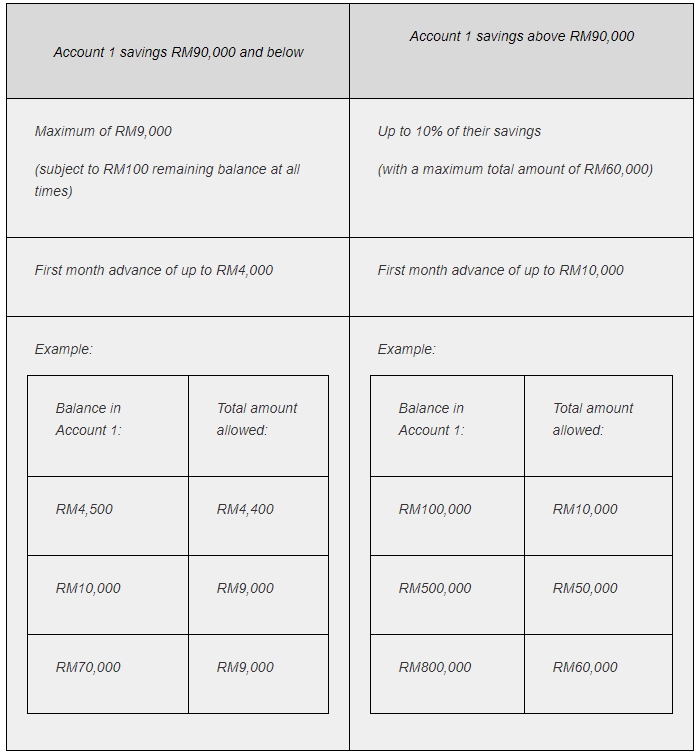

Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000. For those with balances of more than RM100000 they can withdraw up to 10 of their Account 1 savings capped at a maximum of RM60000. Contributors with RM100000 and below in their Akaun 1 are allowed to withdraw up to RM10000 with payments to be disbursed over a maximum period of six months.

1 Get out of dangerous or abusive situations. If you have to take your own retirement money out then use it to. SOALAN LAZIM PANDUAN PENGGUNA.

The i-Sinar withdrawal will be paid out across a period of 6 months. Permohonan Baharu Permohonan akan tamat pada 30 JUN 2021. KUALA LUMPUR Dec 2 The Employees Provident Fund EPF has announced the criteria and details regarding the i-Sinar withdrawal facility which has been further expanded to cover some eight million eligible contributors.

How To Apply For EPF i-Sinar Withdrawal Facility. Meanwhile those with more than RM100000 in their Account 1 are able to make a maximum withdrawal of 10 per cent of the amount in their account or RM60000 whichever is lower. Under i-Sinar affected members can withdraw up to RM10000 or up to 10 per cent of their Akaun 1 savings capped at RM60000 depending on how much balance they have in Akaun 1.

I-Sinar eligible amount. Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i-Sinar. And hence the introduction of i-Citra which would enable contributors to withdraw up to RM5000.

The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. Heres a quick step-by-step application guide. Although i-Sinar has been expanded to make more Employees Provident Fund EPF contributors eligible to withdraw from their Account 1 there are still compla.

It is expected to benefit some 126 million EPF members. If you havent applied yet. For members that have RM100000 or less in Account 1 you are only allowed to withdraw up to RM10000.

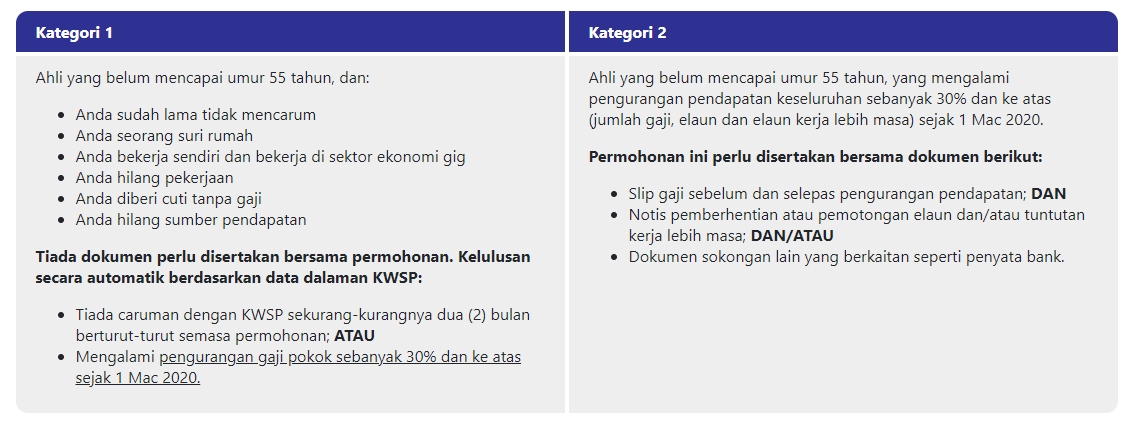

Need extra cash to cover your living. So far EPFs investments and returns have not been affected to the point that would cause i-Lestari and i-Sinar withdrawals to have been a serious policy misstep in hindsight. The eligibility requirements for i-Sinar are also quite flexible with the facility being made available to those whose income have reduced by 30 per cent and those who have not contributed for at least two months.

In a statement today it. Through the facility which expects to benefit half of its 14 million contributors members can withdraw up to RM60000 from their account one. For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000.

Here are the 8 best uses for your EPF i-Sinar money ranked from best to meh. Do note that you are only allowed to make the amendment once. Through the Employees Provident Funds EPF i-Sinar facility members can withdraw up to RM60000 from their Account 1.

With the online i-Sinar application to start on Dec 21 former prime minister Datuk Seri Najib Razak has again called on the Employees Provident Fund. As before the withdrawal amount allowed for i-Sinar is still subject to the members Akaun 1 balance but the criteria have been updated to the following.

How To Withdraw Money From Epf I Sinar Online 8 Best Ways To Use The Money Ringgit Oh Ringgit

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar 8 Other Things You Can Use Your Epf For

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

I Sinar Epf Members Can Get Up To Rm60 000 From Account 1 Here S What You Need To Know

I Sinar The Pros And Cons Of Withdrawing Money From Your Epf Account Lifestyle Rojak Daily

Epf I Sinar Applications Are Now Open Here S How To Apply

Posting Komentar untuk "I-sinar Withdrawal Form"