How To Withdraw Money From Epf For House Loan

For the withdrawal the employee should have reached at least 10 years of service. You can use EPF balance to repay your home loan EMI either fully or partly as per your wish.

How To Withdraw From Your Epf Account To Buy A Home

Total interest paid with EPF Withdrawal Pmt1.

How to withdraw money from epf for house loan. There are four options available and each carry a maximum withdrawal limit. You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site.

One can withdraw from PFEPF account for loan repayment in two ways offline and online. The minimum service requirement is at least 5 years Remodeling or addition in the house and repairs of house The maximum money employee can withdraw is 12 times of hisher monthly wages. As EPF is usually the dominant product for building ones retirement corpus you must re-evaluate the option to withdraw as it will impact the compounding of your returns.

PF money can be used for buying a plot of land which can be availed only once. Withdrawn from EPF will then be credited directly to your home loan account. Repaying the home loan.

The maximum amount that an individual can withdraw from their Public Provident Fund PPF savings is 36 times the basic salary. EPF Withdrawal for Principal Repayment Assuming RM 60k is withdrawn from EPF Account II and transferred into the mortgage account principal repayment on the first day you start to service the loan repayment. You would need a Universal Account Number and a phone number.

Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. Log in with your UAN and password. Moreover one can avail of this facility only once.

You can withdraw PF for home loan repayment either online or offline. They can withdraw from the balance in their provident fund PF account subject to certain conditions and within certain limits. Buying a Home as an Individual.

You can avail this partial withdrawal facility only once in your life for housing purposes. Yes you can use it to repay the home loan EMI for the accumulated EPF corpus. 1 Purchasing a home with a 100 home loan.

PF Withdrawal For Home Loan Repayment Procedure. EPFO will transfer the money to your bank monthly as long as there is sufficient EPF balance in your account. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house.

If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service. You are also allowed to withdraw your EPF balance to repay your home loan. For that you have to instruct the EPFO.

Those who want to opt for offline mode are required to submit a. Those who want to close their home loan a little faster can do the same by taking the loan against PF or withdrawing money from their PF account. Go to the Online Services tab and then choose Claim.

With around 25 years of your loan tenure left you have already paid the majority of the interest component and further EMIs will have a higher share of the principal. This depends on the specifics of your purchase. Owning your dream home is now made easier with EPF withdrawal.

The withdrawal amount sanctioned for this reason. An employee can prepay the home loan by withdrawing the PF amount. Go to the EPFO portal.

36 times of monthly salary or Total contribution or The total outstanding home loan amount. EPF allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. The maximum you may withdraw under a zero-down home loan is 10 of the home price to.

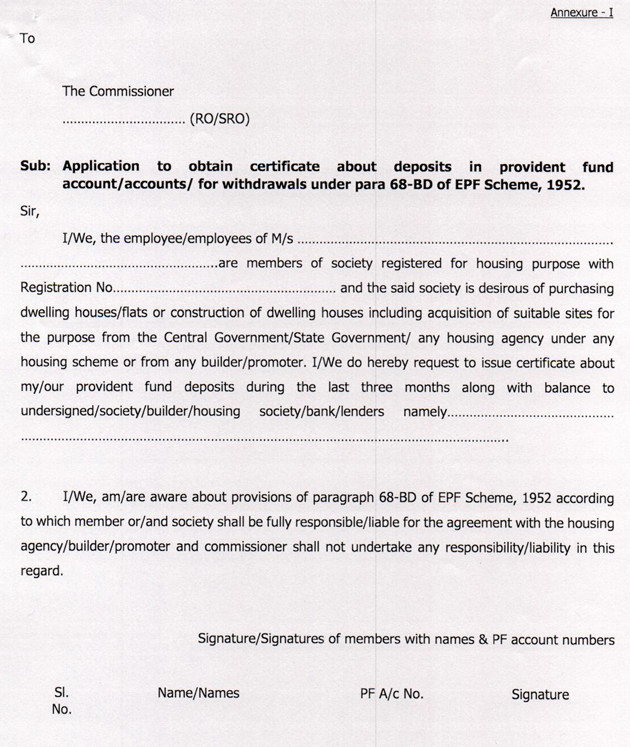

Follow the steps below. The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees. The withdrawal is done through the From 31 form for EPF partial withdrawal.

For the purpose of repaying the outstanding home loan the PF member is allowed to withdraw up to 90 of the corpus if the house is registered in his or her name or held jointly However to withdraw the amount at least 3 years of complete service is required. You are allowed to withdraw from EPF Account 2 to finance the downpayment purchase of a house. The money thus withdrawn can be used for various purposes like buying a plot or a house.

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

How To Withdraw From Provident Fund Account For Home Loan Repayment The Financial Express

Info How To Purchase A Property Using Your Epf Withdrawal Money Mymetrohartanah

Info How To Purchase A Property Using Your Epf Withdrawal Money Mymetrohartanah

Epf Partial Withdrawal Or Advance Process Form How Much

6 Reasons For Which You Can Withdraw Money From Your Epf Account

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Epf Partial Withdrawals Advances Options Guidelines 2020 21

60 12 6638425 Epf Withdrawal To Purchase A House

Posting Komentar untuk "How To Withdraw Money From Epf For House Loan"