How To Withdraw My Epf Amount

I want to withdraw my previous companys PF amount along with pension. EPF Employees Provident Fund.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

But if you want to withdraw that money in between jobs So here you can withdraw that money According to your need Like if you are your sons or daughters Siblings or if even their own Even for marriage if you want to withdraw money.

How to withdraw my epf amount. Epf no no 100467386066 claim id WBTLO181150000383 PH 7278129482. In case individuals withdraw the pension amount when they attain the age of 50 years they will receive a lesser EPS amount. Sending the SMS.

To see the amount of savings you should have at your current age click here. This way the person will not have to think of borrowing from anywhere and can use his money at the time of need. Ive been contributing to EPF and EPS all these years.

Hi Manish In case you wish to withdraw your EPF amount which is more than or equal to Rs50 000 with less than 5 years of service then TDS is deducted at 10 if you submit the PAN Card But 15G form for EPF15H is not submitted or TDS will be deducted at the rate of 34608 if you fail to submit the PAN Card. So here the total amount invested in the epf You can withdraw up to 50 amount Same friends if you are your son. The EPF Scheme 1952 provides for the grant of advance to its members in case of an epidemic.

December 7 2017 at 943 am. Log in to Reply. So that when you find yourself in a tight spot financially you can make a withdrawal from your Account 2 to help cover your monthly housing loan instalment for a minimum period of six months or until your financial recovery.

In an effort to ease the burden of homeowners the EPF introduced the Housing Loan Monthly Instalment Withdrawal. Please contact your Local EPF Office as they may be able to help you in this regard. My question is will the withdraw amount be calculated as 98815000 which is as per revised amount or will it be 6500754 15000205.

If you decide to quit your job and withdraw the balance from your EPF account once and for all you will only be able to remove a portion of the amount based on the purpose of withdrawal. The SMS must be sent in the EPFOHO UAN ENG format. EPF CEO Datuk Seri Amir Hamzah Azizan said all members below the age of 55 are eligible to apply for i-Citra which allows them to withdraw up to a maximum of RM5000 subject to their total combined balance in both Account 1 and 2.

Based on that chart if you have an excess of money that is you have saved more than your Basic Savings for your current age you can actually invest your money in EPF approved fund management. Sir I have resign my previous company 7 month back and I have joined another with new PF account and UAN. The EPFO member can now simply send an SMS to 7738299899 to check the EPF balance and last contribution amount.

EPF Form 11 is a declaration form which has to be submitted by an employee when taking up new employment in an organization which offers EPF Scheme Employees Provident FundThis form contains basic information regarding the employee like name date of birth contact details previous employment details KYC Aadhar Bank account PAN etc details. To elaborate if the EPF balance UAN number is 123456 and the language of preference is English then the SMS to be sent is EPFOHO 123456 ENGHere the first three letters of the. Individuals who have not completed 10 years of service but are unemployed for 2 months or more will be allowed to withdraw the EPS amount.

I am sourav adhikary my epf account no 100467386066 i applied epf advance for my family illness rs 50000 amount are approved 13112018 and status sowing amount are dispatch 13112018 Has been via NEFT but till now now any amount dispatch in mySBIaccount. Some of the valid reasons are unemployment retirement purchase of land purchaseconstruction of a house renovating a house wedding education repaying a home loan and medical reasons. In a statement Monday June 28 EPF said members can begin applying for the facility on the i-Citra online portal at icitrakwspgovmy starting from July 15 2021 with the first payment.

Im planning to withdraw my EPS amount post December. Provident Fund account correction transfer merger check balance rules read statement marurity amount download passbook calculate interest rate on Economic Times. Know all details about PF account.

I have a EPF account from 2011 Sept till date the problem is my company is acquired by another company on 2014 and the the PF account has been changed from Madurai to Bangalore and still maintained there While I am trying for partial Withdrawal for at least 90 through online the Date of Joining is 2014 not 2011 so it comes as a not eligible criteria to withdraw the amount under House. Throughout our working life there is a basic savings amount that EPF has determined is required for each age group. I have 9 years of service and quitting my Job by Dec 2015.

In March 2020 the government announced that a person can withdraw a part of the amount from its EPF account. You can withdraw up to 75 per cent of your EPF account balance or three months basic salary plus dearness allowance or the amount that you.

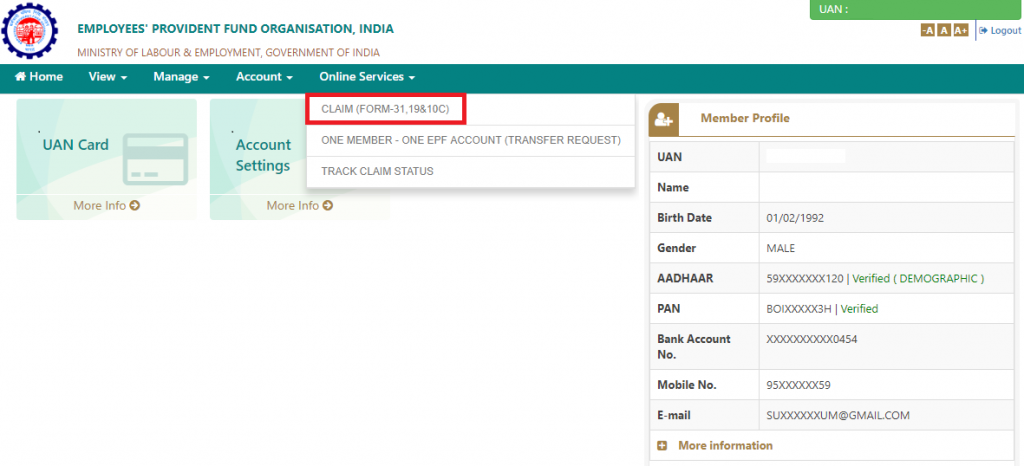

New Online Epf Withdrawal Facility For Pf Eps Claims

How To Withdraw Epf And Eps Online Basunivesh

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

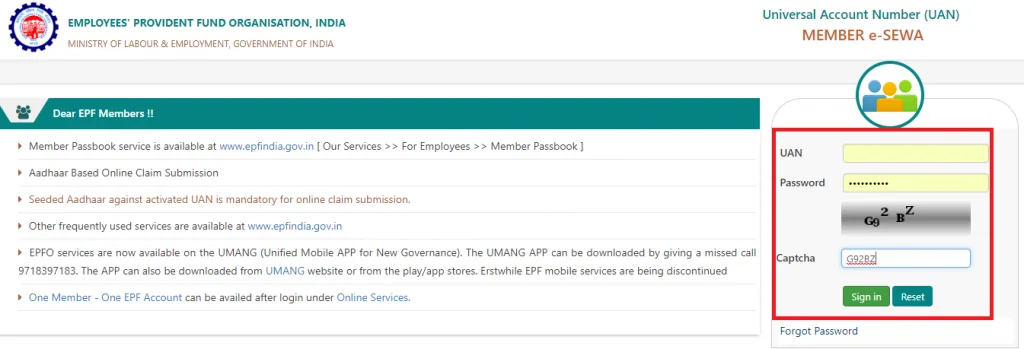

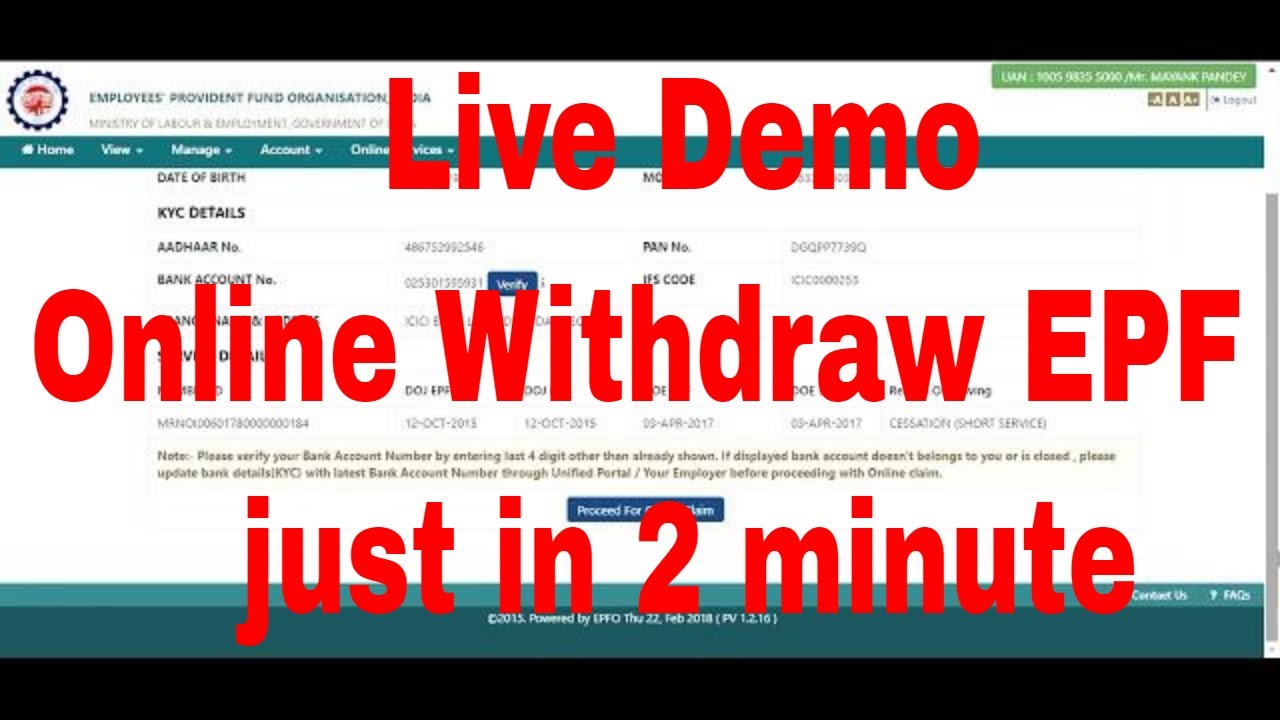

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

Epf Withdrawal Process How To Withdraw Pf Online Updated

Withdraw Pf Without Leaving Job Of Current Company Planmoneytax

Pf How To Withdraw Pf Online Without Employer Signature Youtube

![]()

Epf Withdrawal Online Epf Withdrawal Procedure Updated You

Pf Withdrawal Form Know Epf Withdrawal Procedure

Posting Komentar untuk "How To Withdraw My Epf Amount"