How Much Can I Withdraw From Kwsp

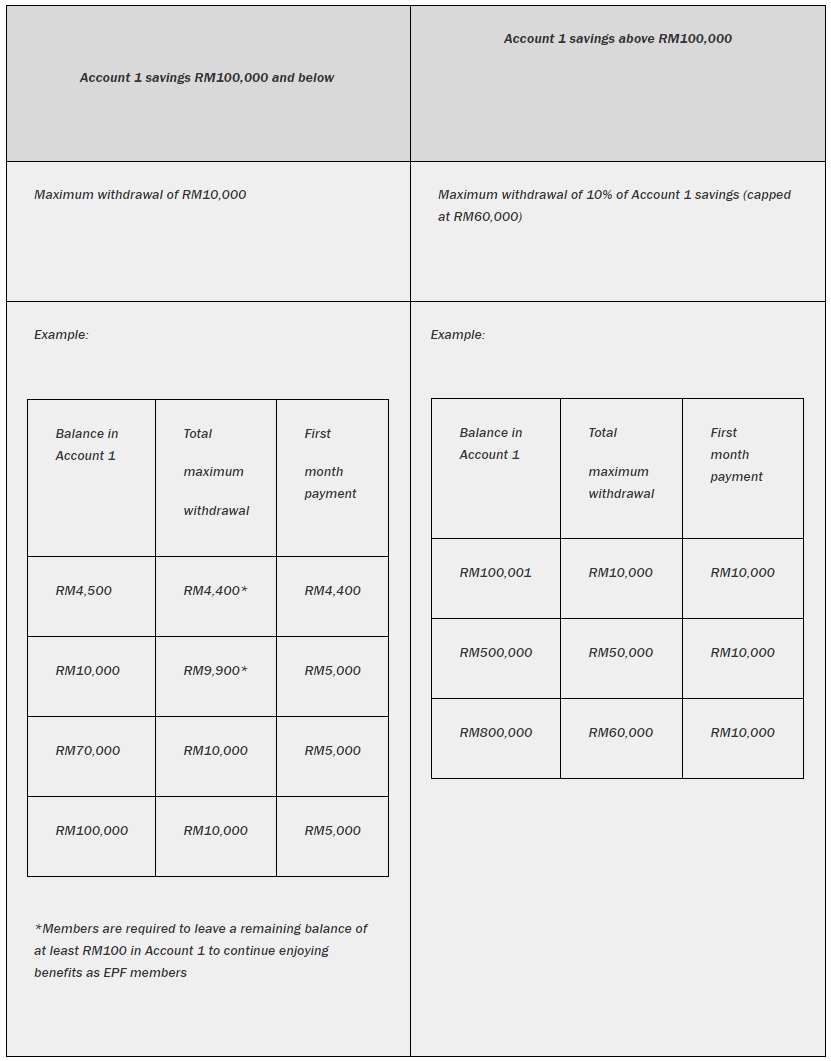

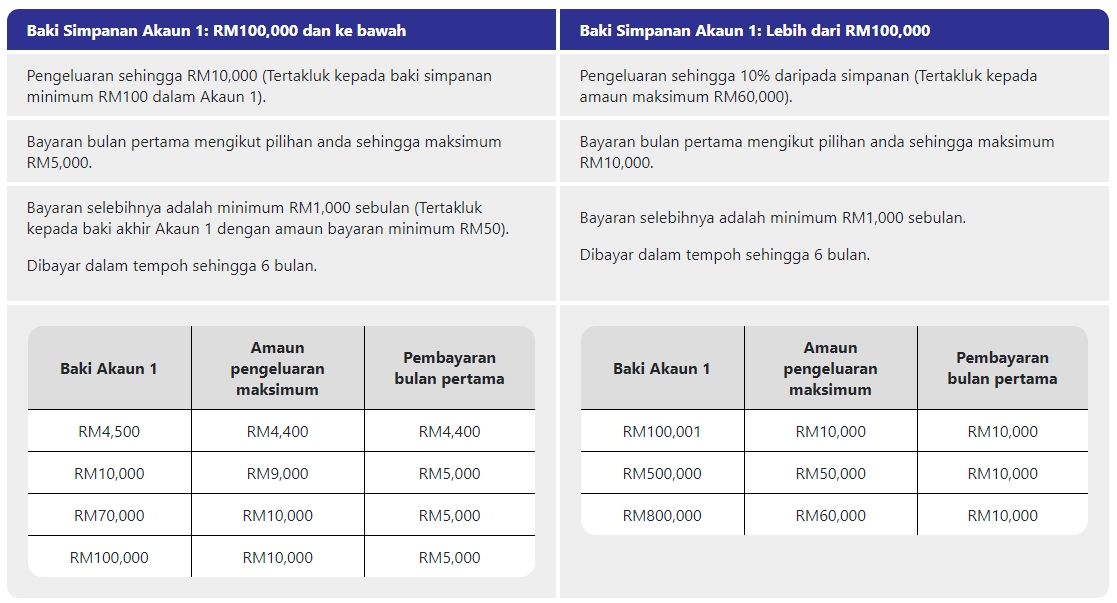

Information is for general reference only is an unofficial summary based on EPFs official website. For this lower eligibility members will be able to take out a maximum of RM10000.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

From there select new application and then i-Lestari when asked for what type of withdrawal you want to make.

How much can i withdraw from kwsp. Under the i-Lestari Withdrawal scheme eligible EPF members can withdraw up to MYR500 per month from Account 2 for a period of 12 months starting from 1 April 2020 until 31 March 2021. Rules of EPF withdrawal are further simplified by the government. As of November 2020 you can payment for EPF Self Contribution via cash bank draft cheque and online banking through the following channels.

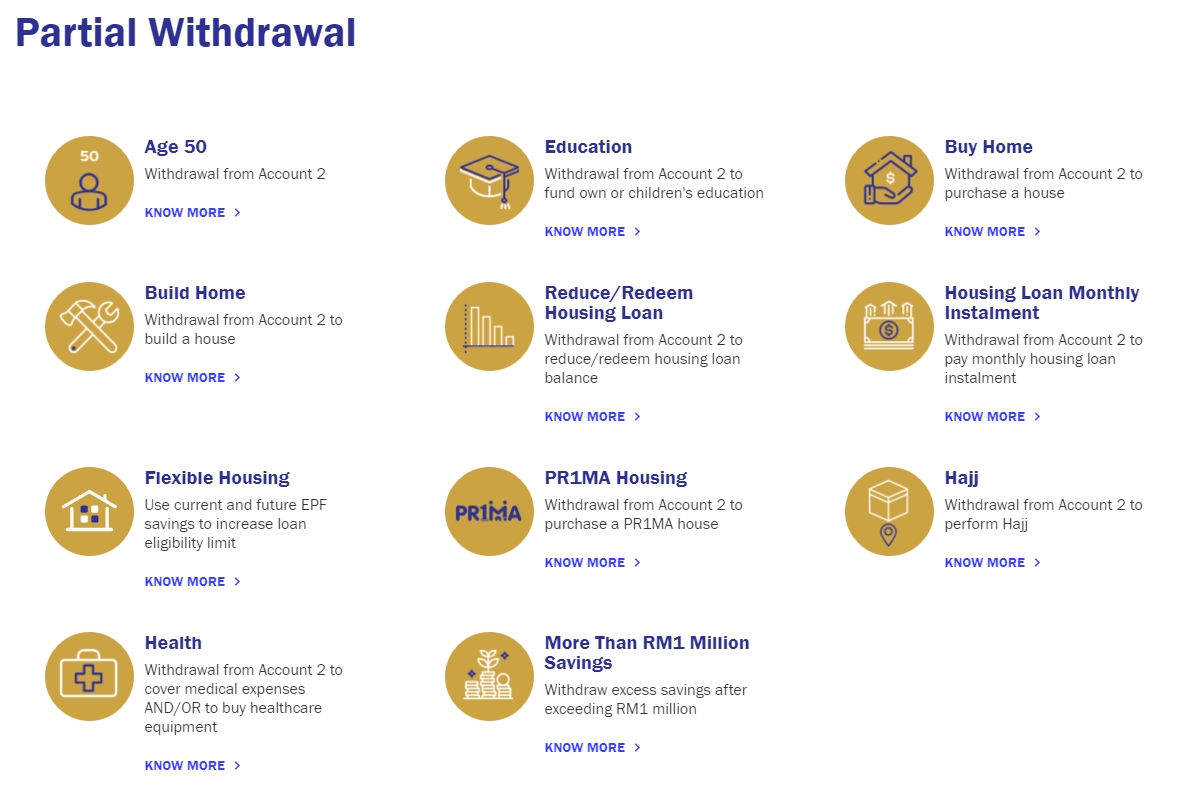

There are four options available and each carry a maximum withdrawal limit. This is open to all members aged below 55 years old. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

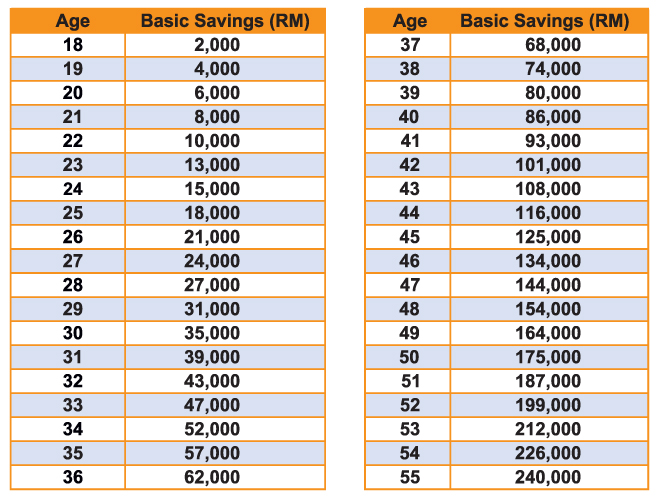

Additional forms documents required. Jane withdrew under the old EPF format which has got 3 accounts. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

For more details on types of withdrawal and how to go about checking their website is highly recommended. This depends on the specifics of your purchase. Details on Malaysias EPF KWSP Account 1 VS Account 2 withdrawals.

EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members. From there you will be asked to specify how much you want to withdraw each month to a maximum of RM500 and which bank account will receive the funds. The 15 different categories of withdrawals have been divided into Account 1 only Account 2 only both accounts withdrawals.

You can make cash payment maximum RM500 or cheque payment at EPF counters nationwide. 30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical. You can only make a one-time partial withdrawal of all or part of your savings in Account 2 when you reach age 50 to help you take the necessary steps in planning for retirement.

Now EPF subscriber can withdraw funds from EPF account for the medical treatment with self-declaration. When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2. What happens if the nominee is below 18 years old.

You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. How much can be withdrawn. Old Format 50 Can withdrawal 13 of total amountie.

Since 5 or 6 years ago it has merged into Account 1 70 and Account 2 30 for current contributions. The earlier requirement of producing a medical certificate from a doctor is removed from immediate effect. Please DO NOT refer to the submission information in Employees Provident Fund KWSP website.

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. This is the most common form of EPF withdrawal. How much can you withdraw.

From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times. Only new composite claim form and self-declaration is enough for EPF. New Format 50 Can withdraw ALL in Account 2 only.

And do take note that you will need to fill in Form KWSP 6A 1. 3333 55 Can withdraw ALL. 1 Purchasing a home with a 100 home loan The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees.

How To Withdraw EPF Money Reaching 50 Years Old. Age 505560 Withdrawal. You can apply for withdrawal through i-Akaun.

The maximum amount that you can take out from Account 1 depends on your current balance. Withdrawal to Purchase Build a House Withdrawal Of Savings Of More Than RM1 Million Housing Loan Monthly Installment Withdrawal Death Withdrawal Flexible Housing Withdrawal Health Withdrawal Hajj Withdrawal afaik is can withdraw for up to. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house.

You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Savings in Account 2 can be withdrawn under specific conditions. The entire amount of the deceased members EPF savings can be withdrawn.

Know How much you can withdraw from your EPF September 1 2020 Mehak Bagla Saving Schemes The global Novel Covid-19 or Coronavirus pandemic has hit the worlds economy drastically and could have created a hole in the pockets of many.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Withdraw From Your Epf Account To Buy A Home

I Lestari How To Withdraw Rm500 Month From Your Epf Account

Posting Komentar untuk "How Much Can I Withdraw From Kwsp"