How To Calculate Epf Withdrawal Amount

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. EPF Calculator with withdrawal rules.

Epf Calculator Calculate Emi For Employees Provident Fund The Economic Times

The tax is charged at the rate of 34608 if the PAN is not submitted.

How to calculate epf withdrawal amount. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020. You will only be shown the options for which youre eligible. How to Withdrawal EPF Balance Log in to the UAN member portal here Go to the Online Services section Click on Claim Form 31 19 10C and 10D Enter the last four digits of your bank account Click on Proceed Online Claim From the dropdown list.

The employer contribution and the interest. 4Next you need to provide the known details of the inoperative EPF account and click on next button. Employees Provident Fund Scheme EPF 1952 Employees Deposit Linked Insurance Scheme EDLI 1976 Employees Pension Scheme EPS 1995 EPF EPS and EDLIS are calculated on the basis of your Basic Dearness Allowance DA including cash value of any food concession allowed to the employee Retaining Allowance RA if any.

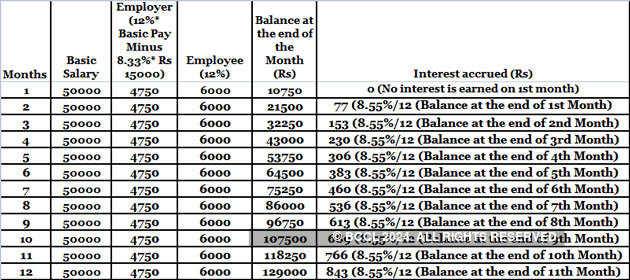

The Employees Provident Fund calculator will help you to estimate the EPF amount you will accumulate at the time of retirement. As soon as you input the values the employers contribution EPSEPF total interest earned and total maturity amount will be reflected in the results. With effect from 10th Feb.

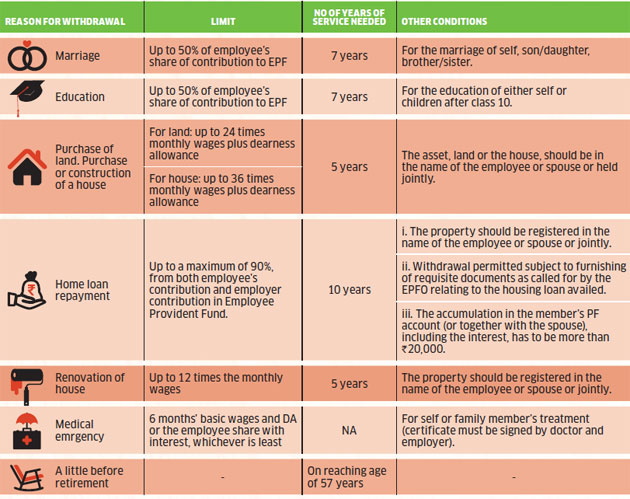

Just input the values and the result will be generated within seconds. How to calculate the withdrawal amount. You can withdraw EPF amount for a similar reason for maximum 3 times.

3On the next screen you need to provide the problem description and click next button to proceed. Calculation Made Easy. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Select reason for withdrawal Youll find a dropdown menu from which you would need to choose the reason for withdrawing from your PF account. Firstly enter your age on Scripboxs EPF Calculator. You can then click on Proceed for Online Claim 5.

Enter the details and the calculator will do the rest. Tax on PF withdrawal is charged 10 if only PAN is submitted and no 15G15H is given. Hope this post can give all of you an insight on this matter.

Total EPF balance at the end of the year Balance at the end of 12 month Employee plus the Employer contribution Sum of the interest earned in each month in. This tax is levied provided that the amount claimed for withdrawal is equal to or above Rs. For withdrawals after 5 yrs of employment there is no TDS.

2016 EPF subscribers can only withdraw their contribution and the interest it earns in the EPF account if they quit their job before the age of 57. Your employers EPF contribution - Your employers contribution towards EPF is 367 of Rs25000 which comes to Rs91750 per month. 5Next screen you need to provide your basic details.

Latest news related EPF withdrawal. 75 of the EPF balance can be withdrawn after one month of unemployment and the remaining 25 can be withdrawn after two months of unemployment. No you cant withdraw all your EPF funds only 50 of the total amount is allowed to withdraw.

You can make this withdrawal in case you have switched your job and do not want to get yo. Let us look into the step by step process on how to use the Scripboxs EPF Calculator. Enter your basic salary and your age.

EPF Contributions To Be Deducted at 24 from August 1 2020. TDS Deduction on PF withdrawal before 5 years of service. KWSP - EPF contribution rates.

Confirm Terms Conditions Once youve verified your details you would need to confirm the Terms and Conditions as stated by EPFO. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. You can make a withdrawal claim by filling the EPF withdrawal form online.

This is the new rule now. Ways to Withdraw PF Amount Although withdrawal of PF isnt allowed while you are still employed there are ways to get this amount in case you need it badly. Your contribution towards EPF is 12 of Rs25000 which amounts to Rs3000 each month.

EPF withdrawal claim is made by an employee if he is unemployed or when he retires. Next enter your desired age of retirement basic salary and expected annual increase in salary. Based on the latest government rule inoperative or old PF accounts are now made to generate interests.

Rest will be settled only at the age of 56. Follow by next question. Here is an EPF calculator in Excel that helps illustrate the new EPF withdrawal rules.

Then enter your contribution and employers contribution to. Although EPF members investment scheme was launched years ago yet many Malaysians still do not know the existence of it.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Form Know Epf Withdrawal Procedure

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Pf Advance Withdrawal Form 31 Epfo New Rule How To Withdraw Pf Advance Epf Withdrawal Online Youtube

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Posting Komentar untuk "How To Calculate Epf Withdrawal Amount"