How To Take Kwsp Account 2

The Prime Minister announced last week that members of the Employees Provident Fund EPF would be allowed to withdraw up to RM500 per month from their account. Click the I-Account image.

Contributions received on your behalf from your employer will be credited into the two.

How to take kwsp account 2. How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties How To Withdraw From Your Epf Account To Buy A Home Property Insight Epf Withdrawal To Purchase A. Withdrawal from members Account 2. Effective 1 January 2007 the Account was divided into two parts namely Account I and Account II.

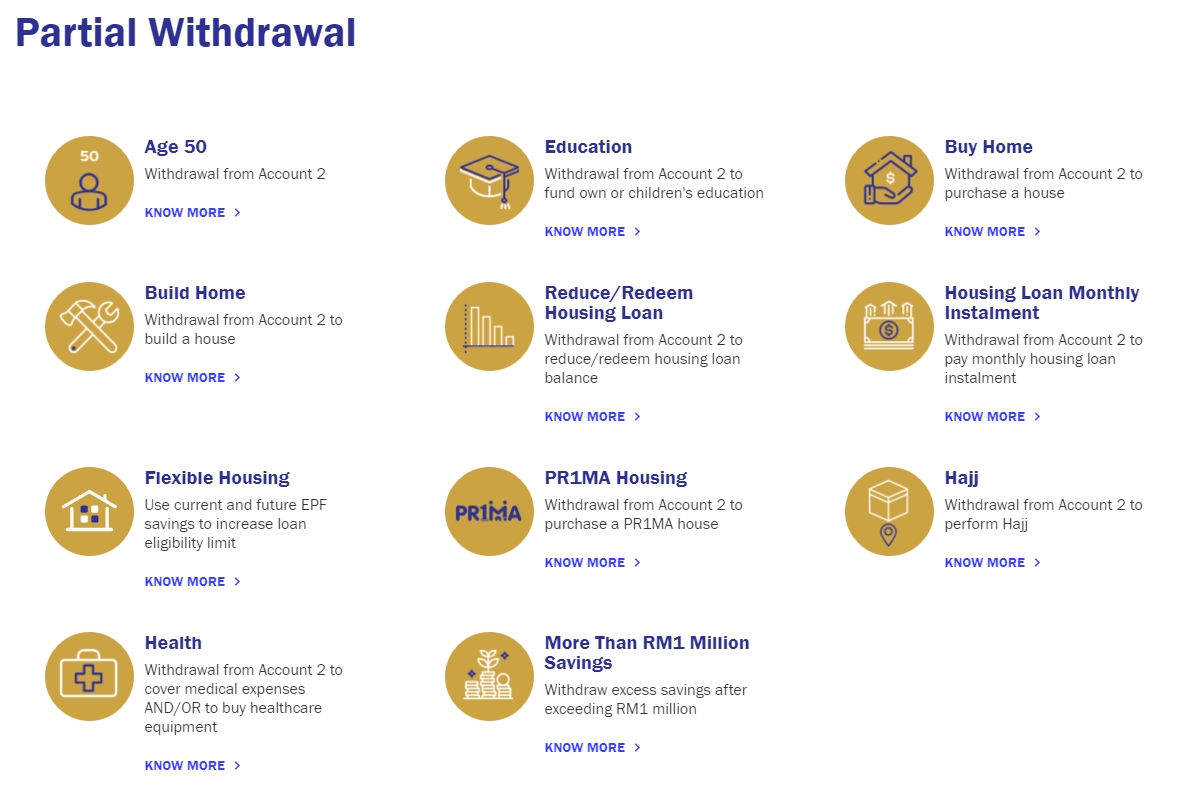

Inquiry on i-Lestari withdrawal. Eligible members will be permitted to withdraw a maximum of RM500 a month to ease their financial situation. Savings in Account 2 can be withdrawn under specific conditions.

For the first withdrawal you are required to submit all of the following. Submission of i-Lestari withdrawal form. PS Websites default language is Malay you can click on the house image at up-right corner area to change it.

Click on the Register Your Member i-Akaun or i-Account. Savings to be deposited in members bank accounts starting May 2020. Amount you can withdraw.

And you also have to sign name. One of the key initiatives is to allow Malaysians to withdraw funds from their Employees Provident Fund EPF account. One copy is given to you as.

From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times. Eligible members can withdraw up to RM500month from Account 2 for a period of 12 months. A photocopy of the bank book for your active account.

Have the choice of withdrawing the full cost before treatment or claim from EPF after. EPF i-Lestari Account 2 Withdrawal Facility. Facility is effective for a maximum period of 12 months.

But given the MCO all EPF branches might be closed. Generally you will have to pay for the following costs upfront and complete the following forms before applying for a withdrawal. For this lower eligibility members will be able to take out a maximum of RM10000.

Patients who have savings in EPF Account 2 for full treatment cost. Withdrawal from Account 2 to cover medical expenses ANDOR to buy healthcare equipment. Heres How To Apply For Withdrawal RM500 From EPF Account 2 Starting Tomorrow.

Visit your nearest KWSP counter and ask for it. Please check the Part 1 here How do apply an online EPF account i-account on KWSP website You can not collect the activation code online you have to collect it offline in either two ways. Once youve registered for your online account you will be sent an SMS that will contain your User ID and temporary password to.

This production facility known as i-Lestari will be available starting April 1 2020. You still have a balance in Account 2 of at least RM60000. Down payment for the house.

You do not have arrears for your housing loan. The maximum amount that you can take out from Account 1 depends on your current balance. EPF also said that contributors can make transactions either through the i-Akaun application or by sending emails for several services.

Navigate to the withdrawals page which should be near the top right corner of the website. The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees. Visit the KWSP website httpwwwkwspgovmy.

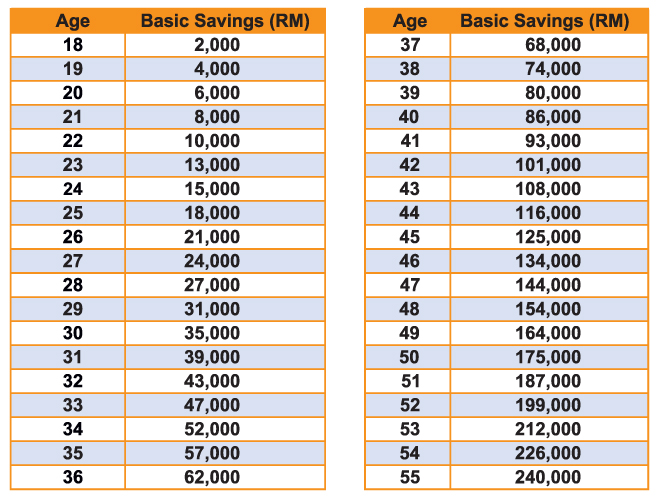

Starting 1 April 2020 for email and post. You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

2 Buying a home as an individual You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than RM500. From there select new application and then i-Lestari when asked for what type of withdrawal you want to make. In this scenario you can just contact KWSP following this link to activate your EPF Account 2.

RM353800 RM318420 10 of RM353800 RM70760. Or the amount of money you have in your Account 2 whichever is lower. All you need to do here is log in to the official EPF website or use the EPF i-Akaun app.

EPF allows pre-retirement withdrawals which in a way enhance the retirement wellbeing of our members. The EPF or Kumpulan Wang Simpanan Pekerja KWSP staff will key in your bank account number. A maximum withdrawal of RM500 per month.

If it is time-sensitive proceed with treatment regardless and let EPF reimburse Sunfert directly to experience a Cashless IVF. Then you have to thumb-print both your left and right thumbs on two copies of the print out forms. Steps of apply the online EPF account.

Bank Confirmation Letter Housing Loan Statement. KWSP Form 9P AHL A photocopy of myKadIC. 30 of your total EPF savings will be in this account from which you can make pre-retirement withdrawals for purposes stated above including housing education and medical.

How To Check Epf I Account Online

Here S How To Withdraw Money From Your Epf Account 2 For Financial Aid This Covid 19 Season World Of Buzz

How To Apply An Online Epf Account I Account On Kwsp Website Part 1 Mkyong Com

How To Withdraw From Your Epf Account To Buy A Home

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

I Lestari How To Withdraw Rm500 Month From Your Epf Account

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf Withdrawal From Account 1 2 What Can They Do For You

Posting Komentar untuk "How To Take Kwsp Account 2"