How To Withdraw Epf For Investment

Investments under the MIS are on a voluntary basis and provide members with another avenue to enhance their retirement savings. However there are many cases where the UAN is.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal.

How to withdraw epf for investment. Members may choose from the list of approved funds which include bonds equities money markets and balanced mixed unit trust funds to invest in. It is an online facility which allows you to withdraw eligible fund from your EPF Saving from Account 1 to make investment ie. EPF rules changed in 2011.

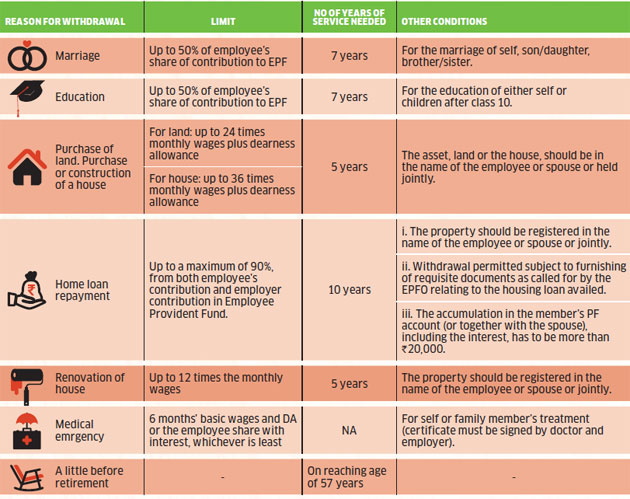

In addition the EPF Act also allows you to withdraw 90 of the corpus one year before retirement provided that you are not less than 54 years old. Login to the portal Visit the EPFO e-SEWA portal and login using your UAN and password and enter the captcha code. Diversify with selected overseas and domestic funds.

Opportunity to optimise your EPF savings. This amount needs to be treated as Salary and pay necessary income tax based on your income tax slab in the year of withdrawal. Indias top entrepreneurial platform recognises the.

Follow these steps to find out how much can be taken out. There are also different withdrawal rights according to the various EPF accounts Akaun 1 and Akaun 2. The Benefits of Investing through EPF-MIS.

Click on Proceed For Online Claim. The Employees Provident Fund Organization EPFO allows EPFO members to check or withdraw their EPF balance using the Universal Account Number UAN. 22 rows The EPF will release control of the amount invested in the FMI when a.

You need to fill up form 31if you want to withdraw partially from your PF Account. If you want to withdraw EPF amount and if you have NOT completed 5 years of continuous service in single or multiple companies the employer share including interest is taxable. If you remain unemployed for more than one month you can withdraw 75 of your accumulated balance in your account.

And enquiring account balances current value history transactions and etc. Types of Investment Schemes Available. Visit EPF UAN portal at this link.

Select the option from Full EPF withdrawal Partial EPF withdrawal or EPS withdrawal. Upon a person becoming disable or in the event of death. A civil servant placed under the pension scheme.

These new rules say if the amount lying in an EPF account is not withdrawn within three years of the last contribution the account becomes dormant and stops earning interest. Buy into unit trust. The Members Investment Scheme MIS is to give EPF members options and to lessen the burden of the EPF because the larger the size of a fund the more complications it faces.

Wide range of EPF-qualified unit trust funds. The UAN number can easily be fetched from the subscribers employer. These emergencies include -.

The EPF agency has listed as of March 2017 over 20 fund management institutions to manage unit trust funds under their investment scheme. When a person migrate to another country. If you are not Eligible to avail the facility of PF withdrawal or pension withdrawal due to the some reason then you will not find that option in the drop-down menu.

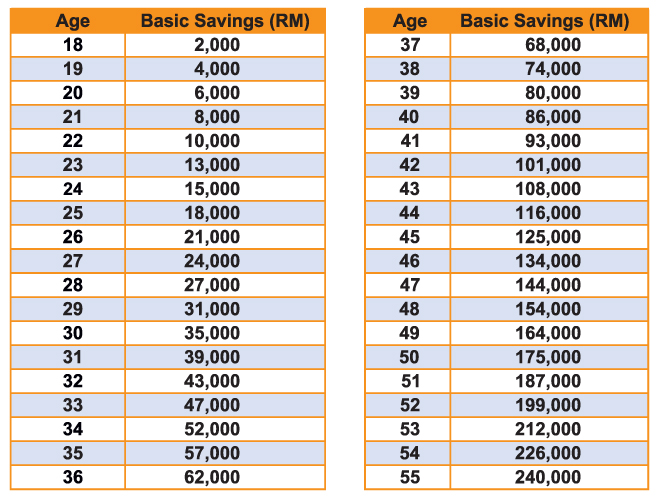

EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. You need to enter the UAN number which would be in your pay slip password and enter the captcha. Withdrawal of EPF Acccount 1 for unit trust investment can be done on a quarterly basis not more than 20 of savings in excess of the Basic Savings amount in Account 1.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Your eligible balance is the lower of the two numbers. What is EPF i-Akaun Investment.

Here are the steps you need to follow. Investment is transacted directly from your EPF Account 1. Transactions can be submitted via this online platform including investment ie.

Once you decide to withdraw this EPF money here is the step-by-step process for EPF withdrawal online. The advance is tax-free and can be obtained without any documentation. When you become 58 years old you can extract 100 of your EPF corpus.

Compute monthly basic DA x 3. There are also other exceptions when you can make partial withdrawals from your EPF account. Compute 75 of EPF account balance.

EPFO does allow to withdraw balance 25 of your EPF account if you are unemployed for more than two months.

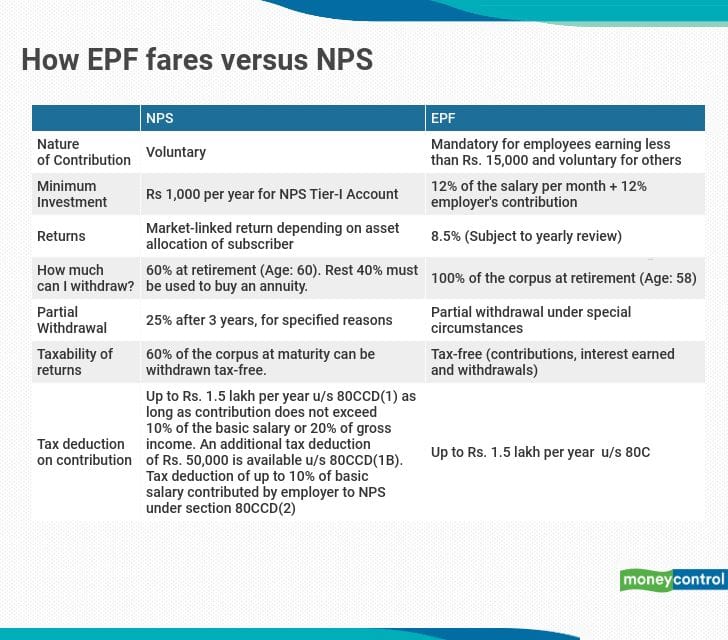

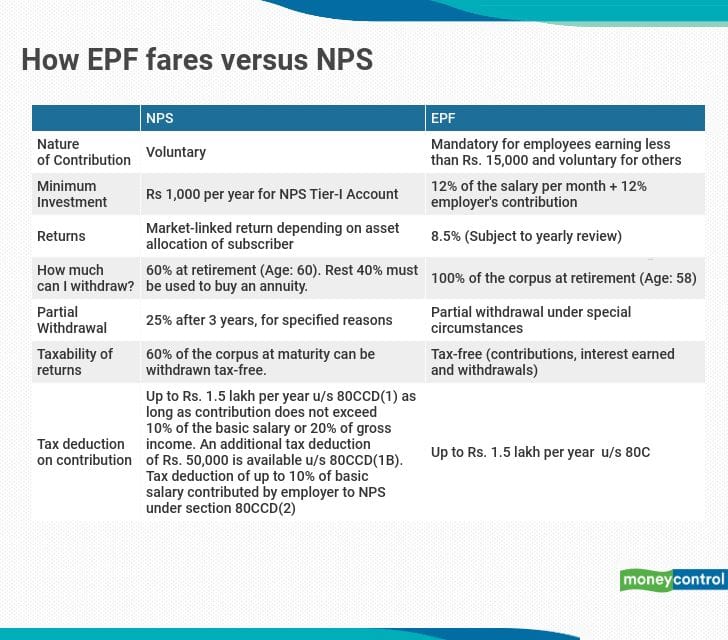

Nps Versus Epf Which Is The Better Retirement Investment

6 Things You Must Do With Your Epf To Secure Your Future Tomorrowmakers

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Online Epf Withdrawal Step By Step Guide To Withdraw Money Online The Economic Times

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

6 Things You Must Do With Your Epf To Secure Your Future Tomorrowmakers

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Posting Komentar untuk "How To Withdraw Epf For Investment"