How Much Can Withdraw From Epf For House

But the new EPF rule will allow you to withdraw only 75 of the EPF amount after unemployment for 1 month. Earlier EPFO members were allowed to withdraw up to 36 months of basic salary plus dearness allowance for purchase or construction of houseflat and 24.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees.

How much can withdraw from epf for house. EPF corpus withdrawal is exempted from tax but under certain conditions. The remaining 25 can be transferred to a new EPF account after gaining new employment. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

And this withdrawal is only possible if one is in the service for 5 years. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site. 7 rows Individuals can withdraw up to 50 of their contribution to EPF.

The rest of the amount will get transferred to your new account after your new employment. You can avail this partial withdrawal facility only once in your life for housing purposes. Approved loan from recognised lenders OR self-financed.

First time as mentioned above whereas the 2 nd time after 10 years from the date of the first withdrawal. EPF Withdrawal Rules 90 of the EPF balance can be withdrawn after the age of 54 years After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and. EPF Withdrawal Rules.

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. Homebuyers can get 90 pct of provident fund for house purchase - Here is how EPF withdrawal rules for a homebuyer say one can use ones EPF or PF account for the purpose of a house land purchase or house construction. Purchase Of HouseFlatConstruction Of House Along With Acquisition Of Site.

An employee can withdraw the EPF amount for a house or flat purchase and construction of house including the acquisition of the. 2 Buying a home as an individual You may withdraw the difference between the price of the home and the loan amount plus 10 of the home purchase price or all the money in Account 2 whichever is lower and not less than RM500. The old EPF rule allowed EPF member to withdraw their EPF amount in full after unemployment for 2 months.

As per the new rule EPFO allows withdrawal of 75 of the EPF corpus after 1 month of unemployment. Residential Home - bungalowterracesemi-detachedapartmentcondominiumstudio apartmentservice apartmenttownhouseSOHO. You can withdraw the amount twice.

Never made a housing withdrawalhave made housing withdrawal before but have solddisposed of the property. As per the PF scheme an employee can withdraw money from his her PF after 3 years of contribution to the purchase of a plothouseflat. If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service.

You can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less. You can withdraw up to 90 of EPF Balance Employee share and interest on thatEmployer share and interest on that or the cost of the construction of property whichever is less. There are four options available and each carry a maximum withdrawal limit.

Purchasing a Home with a 100 Home Loan The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees. One can partially withdraw the amount if heshe has applied for a loan for purchasing or renovating house. As per the old rule 100 EPF withdrawal is allowed after 2 months of unemployment.

EPFO members are authorised to withdraw basic salary and DA of 24 months 36 months or the total amount of employee and employer share with interest or total cost which is subject to the least amount required for buying a house flat or in purpose of construction. At least RM500 in Account 2. EPF withdrawal for house flat or construction of property How much you can withdraw.

Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. An employee can withdraw up to 90 of EPF Balance Employee share and interest on that Employer share and interest on that or the cost of the construction of property whichever is less.

60 12 6638425 Epf Withdrawal To Purchase A House

6 Reasons For Which You Can Withdraw Money From Your Epf Account

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

6 Reasons For Which You Can Withdraw Money From Your Epf Account

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal For Buying House And Paying Emi New Epfo Rule

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

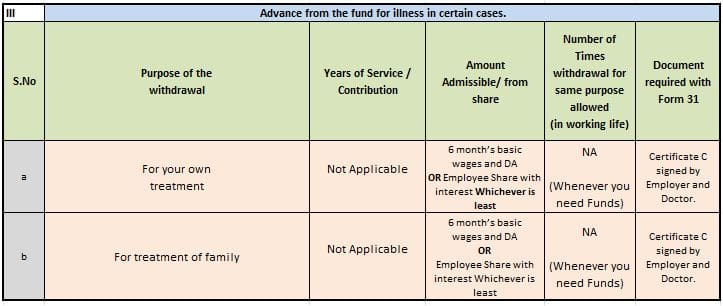

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawal Or Advance Process Form How Much

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Posting Komentar untuk "How Much Can Withdraw From Epf For House"