How To Withdraw Epf For House Renovation

1The house should be held in hisher name or held jointly with the spouse 2The employee must complete at least 5 years of total service 3The member can withdraw 12 times his monthly salary from his Provident fund account. So it will deduct 12000 into your account 2 to and bank in for you in monthly for 1 years.

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Download EPF Composite Claim Form Aadhaar.

How to withdraw epf for house renovation. If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service. Never made a housing withdrawalhave made housing withdrawal before but have solddisposed of the property. If it is offline you have submit an application form for pf withdrawal by get it signed by your previous employer and submit it at your regional pf office along with a cancelled chechque.

6 Buying a third house You may buy a second house but only after you have sold off the first one. The withdrawal is done through the From 31 form for EPF partial withdrawal. But that will be the extent of your withdrawal options for a home purchase.

PF withdrawal for home renovation. An employee can prepay the home loan by withdrawing the PF amount. However if you are planning to migrate you may withdraw all the money in your EPF accounts.

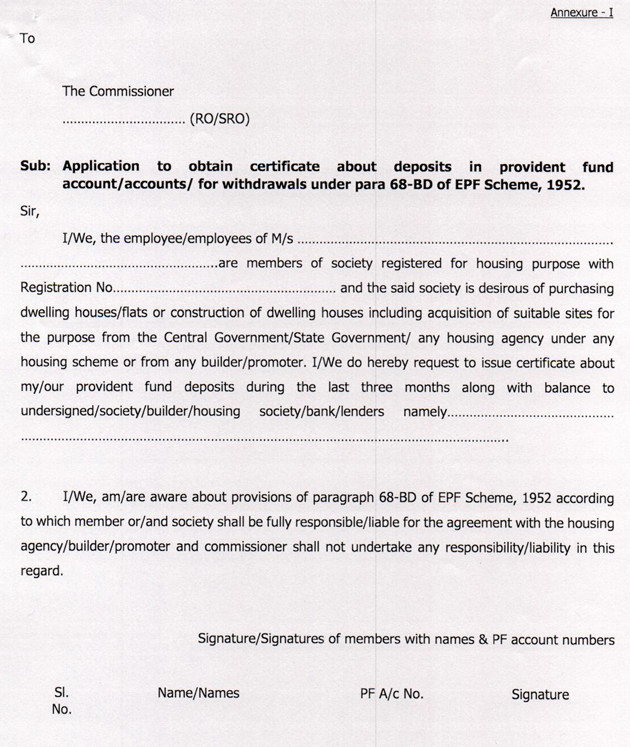

Renovation of the house the employee can withdraw from their pf account for making additions or improvements to a residential house that is owned by self or spouse or jointly. You noticed from above image that for EPF withdrawal for house flat or construction of property you can submit the form through your employer or can directly submit the same to regional EPFO. Other than employees declaration no document is required for this purpose.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. This withdrawal can only be availed after 5 years from completion of the house. For more information and source see on this link.

At least RM500 in Account 2. The employee can withdraw funds from his EPF account for the purpose of renovation and reconstruction. Residential Home -.

For detailed procedure visit-. The house youre going to improvemodify should be at least 5 years. How to withdraw online advance money from EPF account Form-31 for construction of house.

Buy or build house you can only withdraw 2 times in your whole lifetime 2. An employee is entitled to apply for a loan for renovation repair of the existing house owned by either of the spouses or in case of joint-ownership of the property. You are also entitled to withdraw money from your provident fund account for making additions or improvements to a residential house that is already owned by you or your wife or jointly by both.

For the withdrawal the employee should have reached at least 10 years of service. The cheque should be of you as a single account holder and not a joint account cheque. EPF does not allow to use Renovation as the reason to withdraw using the online system will tell you the reason once you choose Renovation D Card PM Report Top.

To withdraw pf full amount you have to be jobless for 2 months then there will two option to withdraw pf. This withdrawal can only be availed of after five years from completion of construction of the house. An EPFO member can apply for an early withdrawal of EPF amount by providing a declaration.

Approved loan from recognised lenders OR self-financed. How to withdraw online advance money from EPF account Form-31 for construction of house - YouTube. They are through offline and online mode.

You should have completed three years of service. Eligibility Criteria For EPF Withdrawal For ImprovingModifying Existing House. Below 55 years of age.

From the restrictions we can see that the EPFs withdrawal options. You must be an active EPF subscriber for at least 10 years. You cant withdraw to buy overseas properties.

How To Withdraw From Your Epf Account To Buy A Home. You can avail this partial withdrawal facility only once in your life for housing purposes. A blank cancelled cheque this is required to verify accuracy of MICR Code Number.

You can withdraw up to 90 of the accumulated corpus for purchase of house or house site. Like this you can save the 12000 for your renovation. Form 10c for EPS withdrawal 3.

Form 19 for EPF withdrawal 2. You can specific Example your housing loan amount is 1000 but you can get your EPF account 2 for RM1000 any amount specific at the TC for 1 years to your bank. However on the safer side wait for it to turn more than 5 years.

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal Process How To Withdraw Pf Online Updated

39 Kwsp Account 2 Withdrawal For House Renovation Pictures Kwspblogs

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Epf Withdrawal Rules When And For What You May Withdraw Your Epf

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Posting Komentar untuk "How To Withdraw Epf For House Renovation"