How To Withdraw Epf Account 1

Click on Proceed for Online Claim to go to the claim form. Part withdrawal loanadvance you have to choose the reason for.

Govt Okays Epf Account 1 Withdrawals Up To Rm6 000 Malaysianow

Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment.

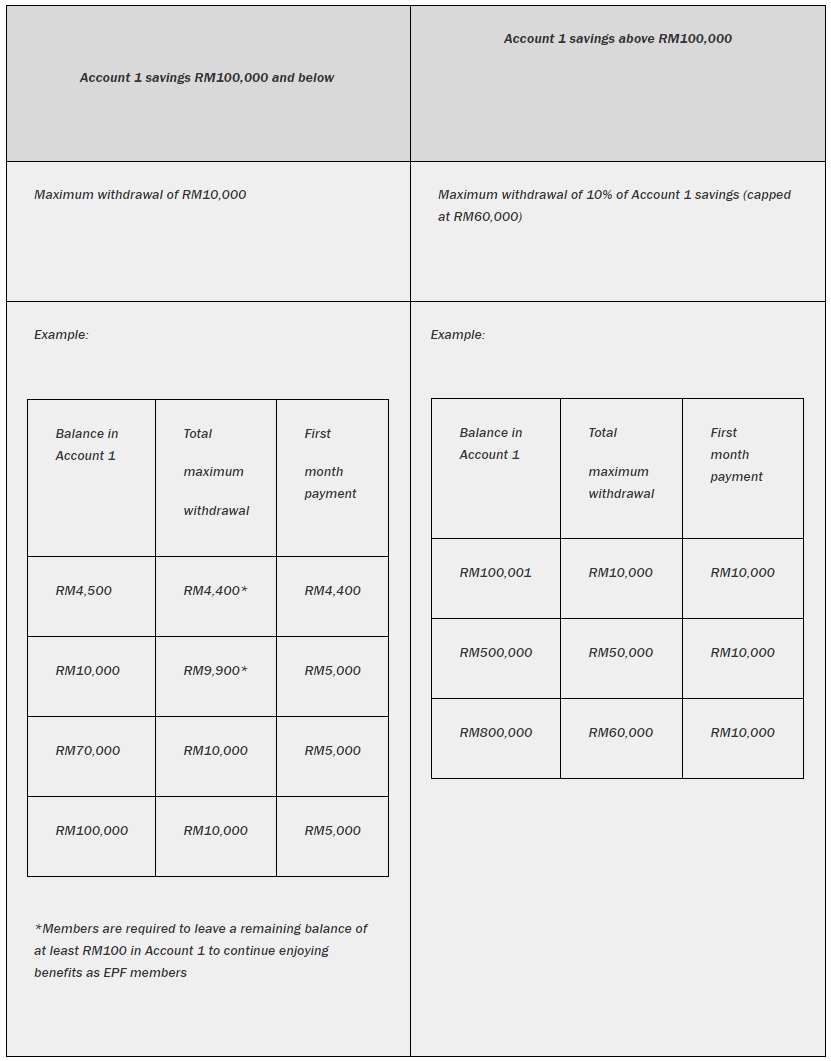

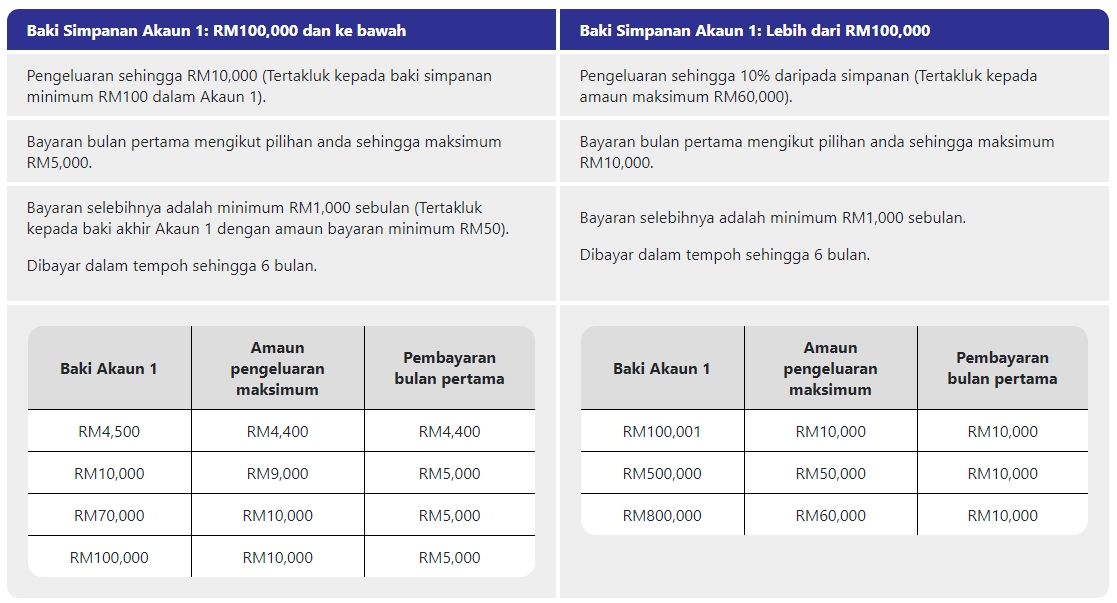

How to withdraw epf account 1. Click the I-Account image. This individual can cease to contribute to the EPF because they are entitled for the government pension scheme under KWAP. If you have RM100000 or less in Account 1 you are only allowed to withdraw up to RM10000.

PS Websites default language is Malay you can click on the house image at up-right corner area to change it. Once you verify the bank account number click on Yes on the certificate of undertaking displayed on the screen. A civil servant placed under the pension scheme.

Applications will begin from mid-December 2020 and the money will be paid out starting 1 month after the application is approved. Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account. The first crediting will take place in January 2021.

Select Payment Schedule. I-Sinar 8 Other Things You Can Use Your EPF for. In the next step you will be required to enter the type of withdrawal.

For this lower eligibility members will be able to take out a maximum of RM10000. Part 1 How to Withdraw Money from EPF i-Sinar Online Step 1. Total 1567 of the contribution goes to account-1.

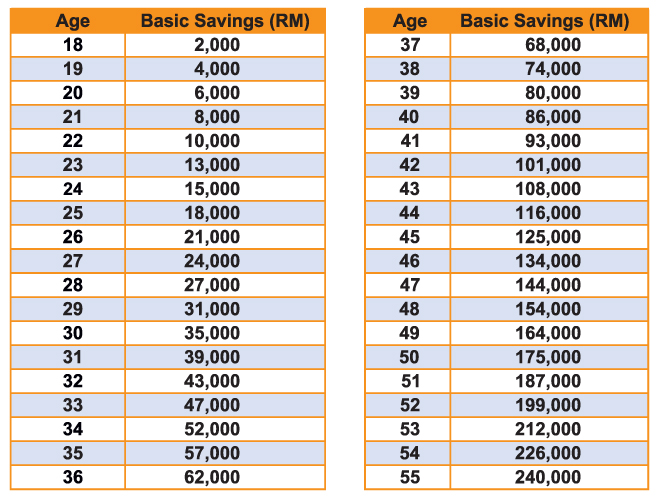

Steps of apply the online EPF account. If you have more than RM100000 you can withdraw up to 10 of your account balance with a maximum cap of RM60000. The maximum amount that you can take out from Account 1 depends on your current balance.

Anyway coming back to the withdrawal there are plenty of. Besides there are some other attributes like date of joining date of leaving updated in the UAn account. Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months.

The government approved withdrawal from Account 1 of the Employees Provident Fund EPF up to RM10000 for those who have lost their jobs or suffered pay cuts this year. Advances will be made over a period. How much money from EPF Account 1 can you withdraw.

How to withdraw money from PF account online 1 Login to your EPFO account using UAN number and password 2 Head to the Online Services tab and select Claim Form-31 19. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said detailed information on the i-Sinar programme would be announced by EPF on that day.

This is the main account for your retirement needs and makes up 70 of your EPF. Heshe can apply for of Online EPF Advance through the Online portal or through Ummang App. Containing 12367 of the pension fund.

To withdraw EPF from old UAN you need to have your KYC approved. Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i. The confusion over the process of withdrawal from Account 1 of the Employees Provident Fund EPF under the i-Sinar programme is expected to be cleared next Wednesday Dec 2.

Bank account number and IFSC approved. In general you have access to 10 of your total Account 1 savings as long as you maintain a minimum balance of RM100. However the actual amount you can withdraw under the i-Sinar initiative is.

KUALA LUMPUR Nov 28. You can associate your aadhaar number yourself to the UAN account online but all other updates need action. If you want to know what else you can do with your EPF monies read.

Under the i-Sinar facility eligible members will be able to start applying for withdrawals from December onwards and the funds will be credited beginning January 2021. Visit the KWSP website httpwwwkwspgovmy. Finance Minister Tengku Zafrul Aziz made the announcement in Parliament today stating that EPF members can apply to withdraw their funds online or visit any EPF office.

When a person migrate to another country. Submit your request. You can withdraw up to RM10000 in the first month.

Upon a person becoming disable or in the event of death. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. From the earlier announcement eligible members with savings of RM90000 and below can withdraw up to RM9000 as an advance provided theres RM100 remaining in Account 1 at all times.

If employee wanted to withdraw partially this money. Click on the Register Your Member i-Akaun or i-Account. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

How To Withdraw From Your Epf Account To Buy A Home

Thinking Of Withdrawing From Your Epf Account 1 Here S What You Should Know Before You Do It News Rojak Daily

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal From Account 1 2 What Can They Do For You

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

Epf Withdrawal From Account 1 2 What Can They Do For You

Posting Komentar untuk "How To Withdraw Epf Account 1"