How Much Can I Withdraw From Epf At Age 50

But as per new updated rules your age must be at least 57 to withdraw 90 EPF corpus amount. When you reach a certain age the EPF allows you to withdraw partially or in full the savings in Account 2.

Epf Withdrawals New Rules Provisions Related To Tds

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

How much can i withdraw from epf at age 50. The withdrawals from the EPF within 5 years of joining are still taxable. You can also withdraw EPF for monthly home instalments. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of.

EPFO allows withdrawal of 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old. Answered 4 years ago Author has 11K answers and 26M answer views Yes a person can withdraw money from hisher EPF account under these condition. Withdraw via i-Akaun plan ahead for your retirement.

When you reach a certain age owning your own home will be high on your list of things to do. Theres a restriction on how many times you can withdraw for childrens higher. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

Youemployee can withdraw the full PF amount on retirement from service 55 years or on cessation of employment and not being employed for at least 60 days. The Employees Provident Fund EPF has enhanced and simplified its policies to enable members aged 55 and 60 to make partial withdrawals of any amount at any time from next January. You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50.

Again a minimum 7-year service period is required for the same. The EPF corpus can be withdrawn if a person faces unemployment before retirement due to lock-down or retrenchment. As discussed above the retirement age has now been.

The EPF subscriber has to declare unemployment in order to withdraw the EPF amount. EPF Withdrawal provisions Existing rule. How To Withdraw EPF Money Reaching 50 Years Old.

Till today 90 EPF corpus amount can be withdrawn at the age of 54. A physically handicapped member can withdraw from his EPF kitty for purchasing equipment required to minimize his hardships. Employees can withdraw 90 of the EPF corpus 1 year before retirement provided the person is not less than 54 years old.

You have the option to withdraw EPF savings at the age of 50 or 55 either partially or fully or at the age of 60 when you can then withdraw any amount of money at any time. Nevertheless it is encouraged that members do not withdraw their savings in Akaun 2 at age 50 because once they withdraw it entirely its gone and they do not earn their annual dividends. Age 50 withdrawal.

The age of retirement has now been increased from 55 to 58 years. You can apply for withdrawal. You cannot withdraw.

You can withdraw 90 of EPF balance once you reach the age of 57 years Earlier a withdrawal was allowed up to 90 of the EPF balance one year prior to retirement ie. In case individuals withdraw the pension amount when they attain the age of 50 years they will receive a lesser EPS amount. 90 of the EPF balance can be withdrawn after the age of 54 years.

Have attained at least 50 years of age to withdraw from the EPS pension at a lower rate Delay withdrawing the pension for by 2 years ie till he or she is 60 years to become eligible to get EPS pension at a rate of 4 annually Different EPS and EPF pension types. If a person withdraws the amount before 5 years of enrolment then 10 TDS is cut if PAN is registered otherwise the TDS is 30. An individual who retires from employment after attaining the age of 55 can withdraw the entire amount of EPF.

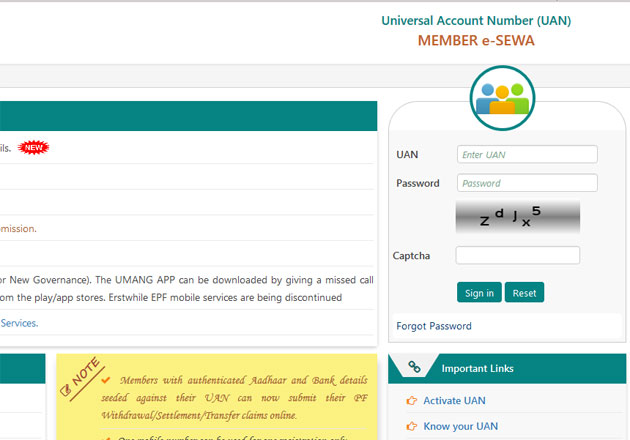

Through this rule an employee can get the opportunity to plan the early retirement before the actual age of retirement. Here are the main amendments to EPF withdrawal rules-. Please DO NOT refer to the submission information in Employees Provident Fund KWSP website.

Individuals who have not completed 10 years of service but are unemployed for 2 months or more will be allowed to withdraw the EPS amount. You can withdraw from your EPF to cover house down payments principal repayments and even building a house from scratch. When one reaches the age of 50 years old he or she is allowed to withdraw all of ones savings in your Account 2.

After 5 years of enrolment Funds are tax free. A member can withdraw the full amount from their Akaun 2 when they turn 50. An employee can withdraw a maximum of 50 of the employees share along with interest.

At the age of 54 years. An EPFO member can withdraw upto 90 of the EPF amount at any time after attaining of the age of 54 years or within one year of his actual retirement on superannuation whichever is later. EPF Withdrawals for Housing.

An individual can withdraw 75 of the provident fund if he is unemployed for more than a month. EPF can also be withdrawn for the purpose of self siblings brother and sister and childrens marriage. For more details on types of withdrawal and how to go about checking their website is highly recommended.

Epf Form 15g How To Fill Online For Epf Withdrawal Basunivesh

I Lestari How To Withdraw Rm500 Month From Your Epf Account

75 Of Epf Can Be Withdrawn Just After A Month Of Unemployment

Pf Withdrawal After Leaving Job How To Apply

Epf Proposes New Options For Withdrawal The Edge Markets

Epf Withdrawals For Those Aged 50 55 And 60 I Akaun Activation To Resume Wednesday Malaysia Malay Mail

Pf Withdrawal Eps Withdrawal How To Withdraw Pf And Eps Money After Leaving Your Job

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

Epf Withdrawal From Account 1 2 What Can They Do For You

Posting Komentar untuk "How Much Can I Withdraw From Epf At Age 50"