How To Withdraw Funds From Pf Account

Visit the Unified Member Portal and login with Universal Account Number UAN and password. Verify Personal Information and PF Account for present employment.

Epf Withdrawal Online Pf Withdrawal Process Application Status Step By Step Guide

You may either choose to withdraw the funds or transfer them to your current or existing EPF account.

How to withdraw funds from pf account. How to transfer money from EPF online. The EPFO has amended the scheme by inserting a new paragraph 68 BD to the Employees Provident Funds EPF Scheme 1952 Under the new provision an EPF. If you want money for treatment or a medical emergency you can withdraw 6 times your salary.

Withdrawing From EPF Account 2 for Covid-19 Aid i-Lestari EPF members can start applying to withdraw money under the i-Lestari scheme starting 1st April 2020 and can expect to receive money in their accounts starting 1st May 2020. This procedure requires identity attestation since the PF office would want to be sure whether the right person is applying for withdrawal. The members willing to withdraw the PF amount can make a claim by filling the EPF withdrawal form online.

One of the worlds largest social security organizations the Employees Provident Fund EPF is a compulsory contribution provident fund that offers saving pension. Submit your PF withdrawal application directly to the regional PF Office. Instead of taking a loan you can withdraw funds from your PF in full or in part.

Follow these steps next. Then Click on Next and Enter Employer information. 3 The website will then display details such as members details PAN card Aadhaar.

In order to withdraw your PF amount using EPFO portal you will need to ensure the following. The employee can withdraw funds from his EPF account for the purpose of renovation and reconstruction The house should be held in hisher name or held jointly with the spouse The employee must complete at least 5 years of total service The member can withdraw 12 times his monthly salary from his Provident fund account. You have an option to withdraw 75 per cent of your funds after one month of unemployment and retain your PF account with EPFO.

Your bank account with the correct IFSC code must be linked to UAN. You are now ready to apply for EPF withdrawal. The subscribers of the Employees Provident Fund Organization EPFO will be able to EPF withdraw up to 90 per cent of their accumulations in their PF account for purchase of homes.

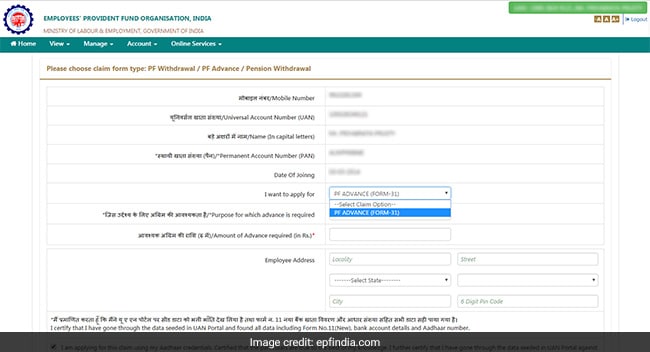

As per the new relaxed norms an Employees Provident Fund Organisation EPFO subscriber can withdraw an amount equal to three months of basic salary and the dearness. How to withdraw money from PF account online 1 Login to your EPFO account using UAN number and password 2 Head to the Online Services tab and select Claim Form-31 19 10C option from the drop-down menu. You can also withdraw money before maturity period in case of emergencies.

Check All Details Here Conditions for Withdrawing Funds From PF Account. Just remember that to initiate the PF withdrawal process you will have to keep your Universal Account Number UAN handy. The transfer option is ideal for all subscribers whose EPF account in question is less than 5 years old.

This is because the proceeds from a PF account if withdrawn within 5 years of setting up the account will attract taxes in the form of TDS. All the withdrawals made before the completion of 5 years is classified as taxable income. EPFO Provides a facility for the subscribers to settle their inoperative PF account through a facility called inoperative helpdesk.

You can withdraw money from your EPF account at the time of retirement and after attaining the age of 55 years. How to Withdraw Money From EPF Account. EPF allows you to withdraw money from your account upon retirement after attaining the age of 55 years.

Go here http10319445139INOPHelpDeskjspsubmitDescriptionjsp and Enter your problem regarding your InOperative account. The amount that can be withdrawn from your PF depends on the status of. The scheme also allows you to withdraw money in case of emergency before attaining.

Helping citizens in need the government last year relaxed the Employees Provident Fund EPF rules and gave them permission to withdraw a portion of their retirement savings. UAN must be activated. Establishment Code Your Company Code PF Account.

The Employees Provident Fund or EPF can prove to have many complications for employees. Get a PF withdrawal form fill it and submit the same directly to the regional Provident Fund Office. To qualify to make a withdrawal you must not be working in the establishment from where you are making a claim of withdrawal.

Go to the Online Services and click One Member One EPF Account Transfer Request Step 3. However they need to note that the online withdrawal. In case there is any unclaimed amount in PF the employee has the option to either withdraw or transfer the amount to the current employer.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Pf Withdrawal Here S How To Claim Online Pf To Meet Financial Challenges Amid Coronavirus

Pf Step By Step Pf Withdraw Process Online By Using Uan Account Complete A Z Youtube

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Epf Withdrawal Online Pf Withdrawal Process Application Status Step By Step Guide

Provident Fund Epf Withdrawal Transfer How To Do It Online

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Step By Step Guide To Withdraw Money Online Information News

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Posting Komentar untuk "How To Withdraw Funds From Pf Account"