How To Withdraw Epf Money For Housing Loan

- EPF housing Loan Form-14 should be filled and certified by the. The withdrawal is done through the From 31 form for EPF partial withdrawal.

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

But that will be the extent of your withdrawal options for a home purchase.

How to withdraw epf money for housing loan. If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service. As EPF is usually the dominant product for building ones retirement corpus you must re-evaluate the option to withdraw as it will impact the compounding of your returns. An employee can prepay the home loan by withdrawing the PF amount.

The Labour Department will check the Forms and forward From No02 based on the information provided in the application to the EPF. So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time.

The Commissioner issues a certificate specifying the monthly contribution of the last 3 months. EPF Withdrawals for Housing. You cant withdraw to buy overseas properties.

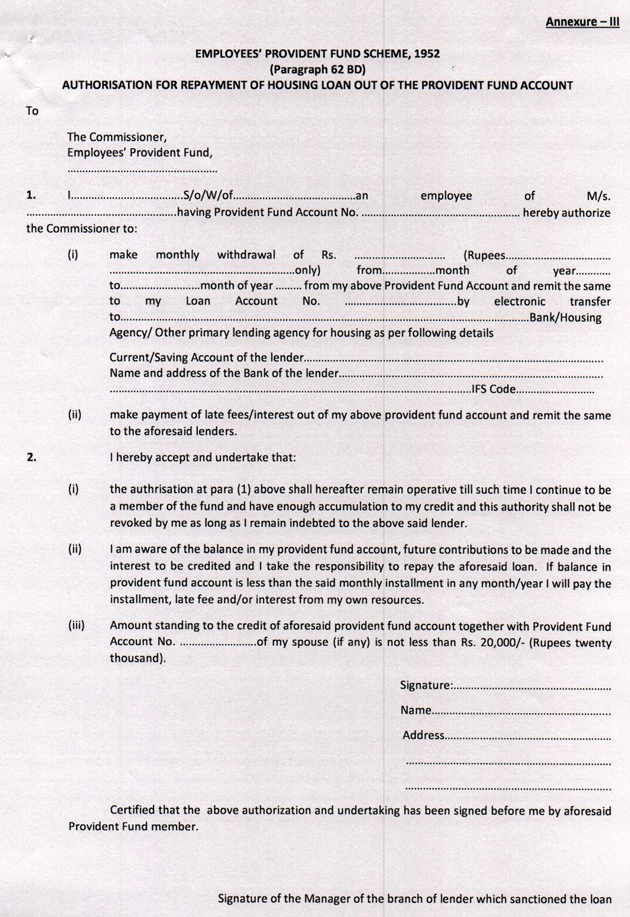

Click here to get WhatsApp number- send ur issue wi. Moreover one can avail of this facility only once. One can withdraw from PFEPF account for loan repayment in two ways offline and online.

EPF Member can apply for withdrawal upto 90 PF accumulations in PF Account EMI facility to members Withdrawal allowed only once Required - PF Membership of 3 years Required - Minimum PF balance of Rs. A member should obtain 2 housing loan application forms from the nearest Labour Office or download from the website and send them back duly filled to the same Office. You can avail this partial withdrawal facility only once in your life for housing purposes.

- The original and the duplicate of the certificate of balance issued by the Central Bank White and Pink of the EPF Loan Form-2 should be submitted along with the above forms. Total interest paid with EPF Withdrawal Pmt1. The maximum amount that an individual can withdraw from their Public Provident Fund PPF savings is 36 times the basic salary.

However if you are planning to migrate you may withdraw all the money in your EPF accounts. EPF Withdrawal for Principal Repayment. Those who want to opt for offline mode are required to submit a.

You should have completed three years of service. You are allowed to withdraw from EPF Account 2 to finance the downpayment purchase of a house. An employee who has completed at least five years of contribution to his provident fund account can withdraw money for the purchase of a plot andor construction or purchase of a house.

1 When the Loan is applied for but not taken. When you reach a certain age owning your own home will be high on your list of things to do. Owning your dream home is now made easier with EPF withdrawal.

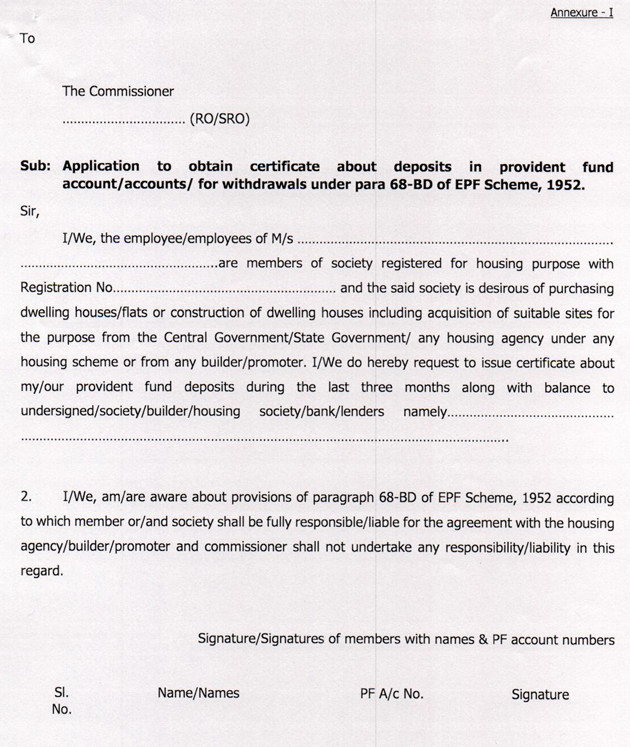

Follow these simple steps to utilize your EPF for repaying your home loan as per the updated EPF withdrawal rules-A PF member can apply for the loan through the housing society to the EPF Commissioner in the format prescribed in Annexure 1. From the restrictions we can see that the EPFs withdrawal options. For the withdrawal the employee should have reached at least 10 years of service.

2 When the loan received has been settled. Assuming RM 60k is withdrawn from EPF Account II and transferred into the mortgage account principal repayment on the first day you start to service the loan repayment. With around 25 years of your loan tenure left you have already paid the majority of the interest component and further EMIs will have a higher share of the principal.

20000 individually or including that of spouse who is also a member of Fund. Find our Whatsapp number in our Official Facebook page please Like and follow us for the latest updates. In the forefront of change in delivery of publicly managed services.

Repaying the home loan. The eligible amount of withdrawal would depend on the purpose for which you are withdrawing the money. 6 Buying a third house You may buy a second house but only after you have sold off the first one.

Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. Those who want to close their home loan a little faster can do the same by taking the loan against PF or withdrawing money from their PF account. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

The amount can be withdrawn for the construction of a house on the plot of land owned either by you or by your wife or jointly by both. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site.

Epf Partial Withdrawals Advances Options Guidelines 2020 21

How To Withdraw From Provident Fund Account For Home Loan Repayment The Financial Express

60 12 6638425 Epf Withdrawal To Purchase A House

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Epf Partial Withdrawal Or Advance Process Form How Much

Withdrawing Epf Funds For Repaying A Home Loan

Info How To Purchase A Property Using Your Epf Withdrawal Money Mymetrohartanah

Epf Withdrawal Online Pf Withdrawal Process Application Status Step By Step Guide

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Info How To Purchase A Property Using Your Epf Withdrawal Money Mymetrohartanah

Posting Komentar untuk "How To Withdraw Epf Money For Housing Loan"