How To Withdraw From Epf Account 1

Over two million Malaysians will be able to apply to withdraw funds from their Employees Provident Fund EPF Account 1 from next month under the EPF i. EPFO Provides a facility for the subscribers to settle their inoperative PF account through a facility called inoperative helpdesk.

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old.

How to withdraw from epf account 1. When a person migrate to another country. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. Tengku Zafruls announcement then was.

Then Click on Next and Enter Employer information. EPF Allows Account 1 Withdrawal Up To RM60000. Applications will begin from mid-December 2020 and the money will be paid out starting 1 month after the application is approved.

In the next step you will be required to enter the type of withdrawal. The employee is free to either withdraw the monies held in the fund after leaving the job or transfer the balance over to the new employer. Use the slider to set your preferred withdrawal amount from Account 1.

You can find out the jurisdiction of your PF office with the beginning alphabets of the PF account number that indicates the state and location. EPF allows full withdrawal of Akaun 1 and Akaun 2 under certain conditions. How to withdraw EPF without UAN.

EPF Withdrawal Online Procedure Follow the steps given below to fill the EPF withdrawal form and initiate a claim online- Step 1- Sign in to the UAN Member Portal with your UAN and Password. Some two million eligible contributors can now withdraw between RM9000 and RM60000 from Account 1 in the Employees. How much money from EPF Account 1 can you withdraw.

Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 19 10C from the drop-down menu. Heres how you can get access to your EPF Account 1 updated PETALING JAYA. Enter your personal details.

Click on Proceed for Online Claim to go to the claim form. Check and confirm your i-Sinar application. The government will allow those who have lost their jobs or suffered pay cuts to withdraw up to RM10000 from their Employees Provident Fund EPF Account 1 Finance Minister Tengku.

3 The website will then display details such as members details PAN card Aadhaar. Go here http10319445139INOPHelpDeskjspsubmitDescriptionjsp and Enter your problem regarding your InOperative account. Enter your bank account details for the payout Bank account must be active.

If you do not have your UAN you need to do is fill a PF withdrawal form and submit it with the regional provident fund office to without money from your EPF account. How to withdraw money from PF account online 1 Login to your EPFO account using UAN number and password 2 Head to the Online Services tab and select Claim Form-31 19 10C option from the drop-down menu. Upon a person becoming disable or in the event of death.

Once you verify the bank account number click on Yes on the certificate of undertaking displayed on the screen. The government will allow all Employees Provident Fund EPF contributors to withdraw up to RM10000 from their EPF Account 1 through i-Sinar said Finance Minister Tengku Zafrul Aziz said in Dewan Rakyat today. He personally said contributors may apply to withdraw their funds online or even visit any EPF office.

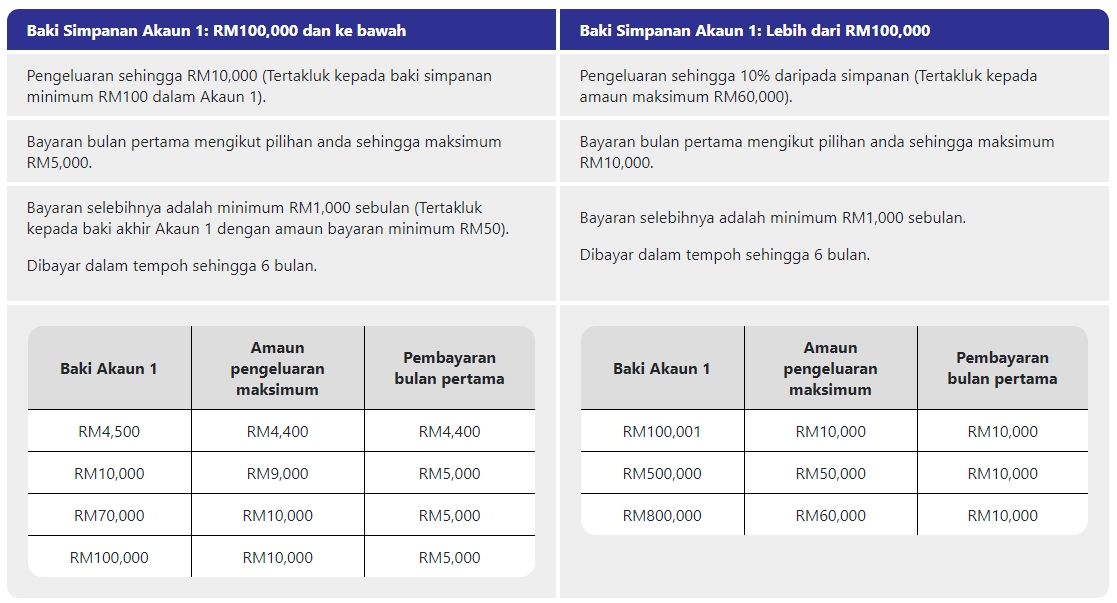

Part withdrawal loanadvance you have to choose the reason for. The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. However the actual amount you can withdraw under the i-Sinar initiative is determined by how much you have in your account.

Under usual circumstances funds from EPF Account 1 are only accessible once members turn 55 years old. In general you have access to 10 of your total Account 1 savings as long as you maintain a minimum balance of RM100. On the next slider set your preferred first payout amount.

This is the main account for your retirement needs and makes up 70 of your EPF. A civil servant placed under the pension scheme. With the advent of UAN Universal Account Number a unique number assigned to the employee for PF purposes it has become furthermore easy to track balance initiate transfers or withdraw the EPF balance.

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. The payout for the subsequent months will be adjusted accordingly. This individual can cease to contribute to the EPF because they are entitled for the government pension scheme under KWAP.

An EPFO member can withdraw an amount equal to three months of basic salary and dearness allowance or 75 per cent of the credit balance in the account whichever is. Previously EPF had announced a RM9000 limit for Account 1 withdrawal.

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Here S How You Can Get Access To Your Epf Account 1 Updated The Star

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know

Budget 2021 Epf Account 1 Members Can Withdraw Up To Rm500 A Month Over 12 Months Youtube

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal From Account 1 2 What Can They Do For You

Epf Withdrawal From Account 1 2 What Can They Do For You

How To Withdraw From Your Epf Account To Buy A Home

Posting Komentar untuk "How To Withdraw From Epf Account 1"