How To Withdraw Epf For House Installment

6 Buying a third house You may buy a second house but only after you have sold off the first one. The withdrawal amount shall not be paid to you directly payment shall be made direct to Cooperative Society or housing agency or builder as the case may be.

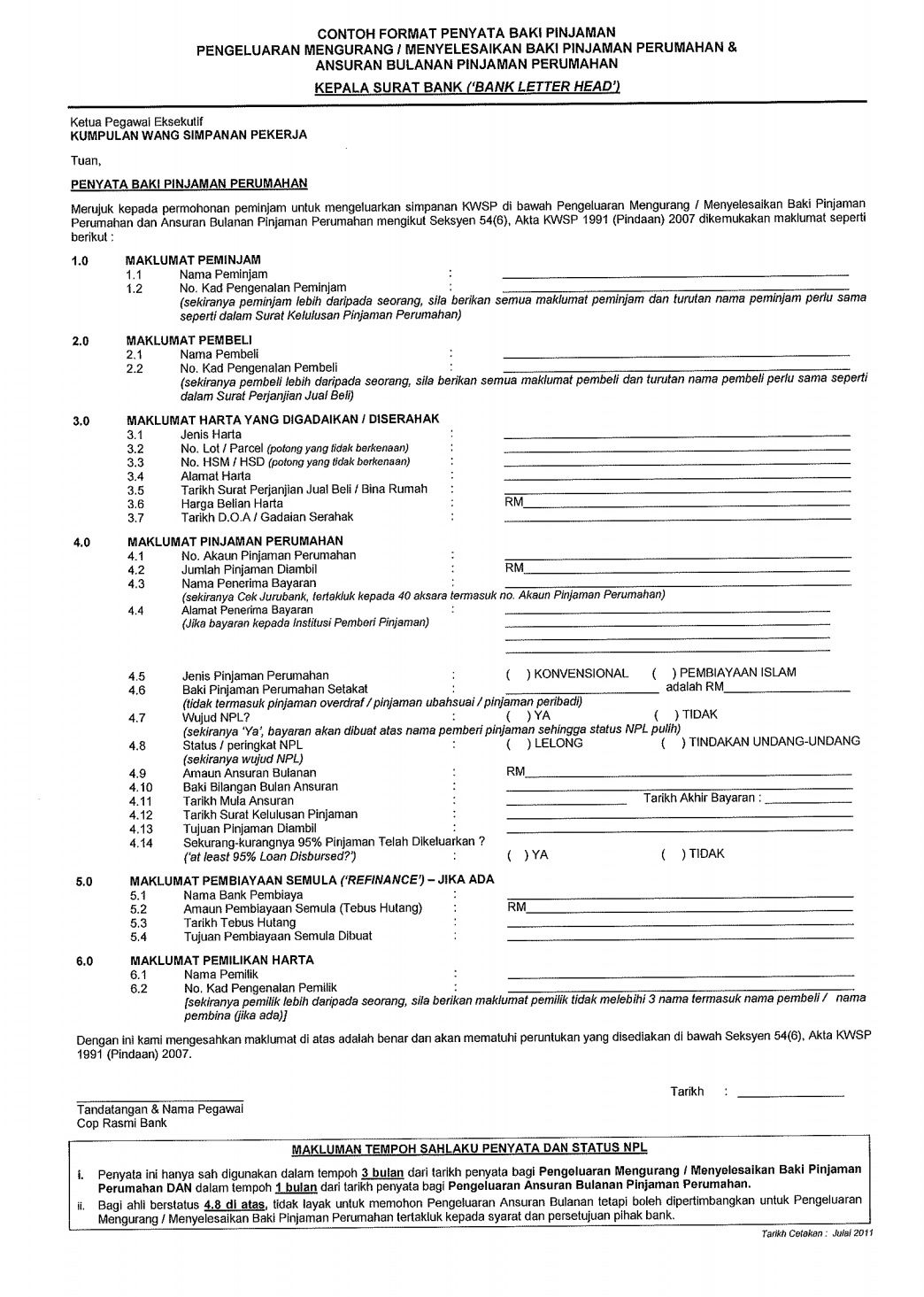

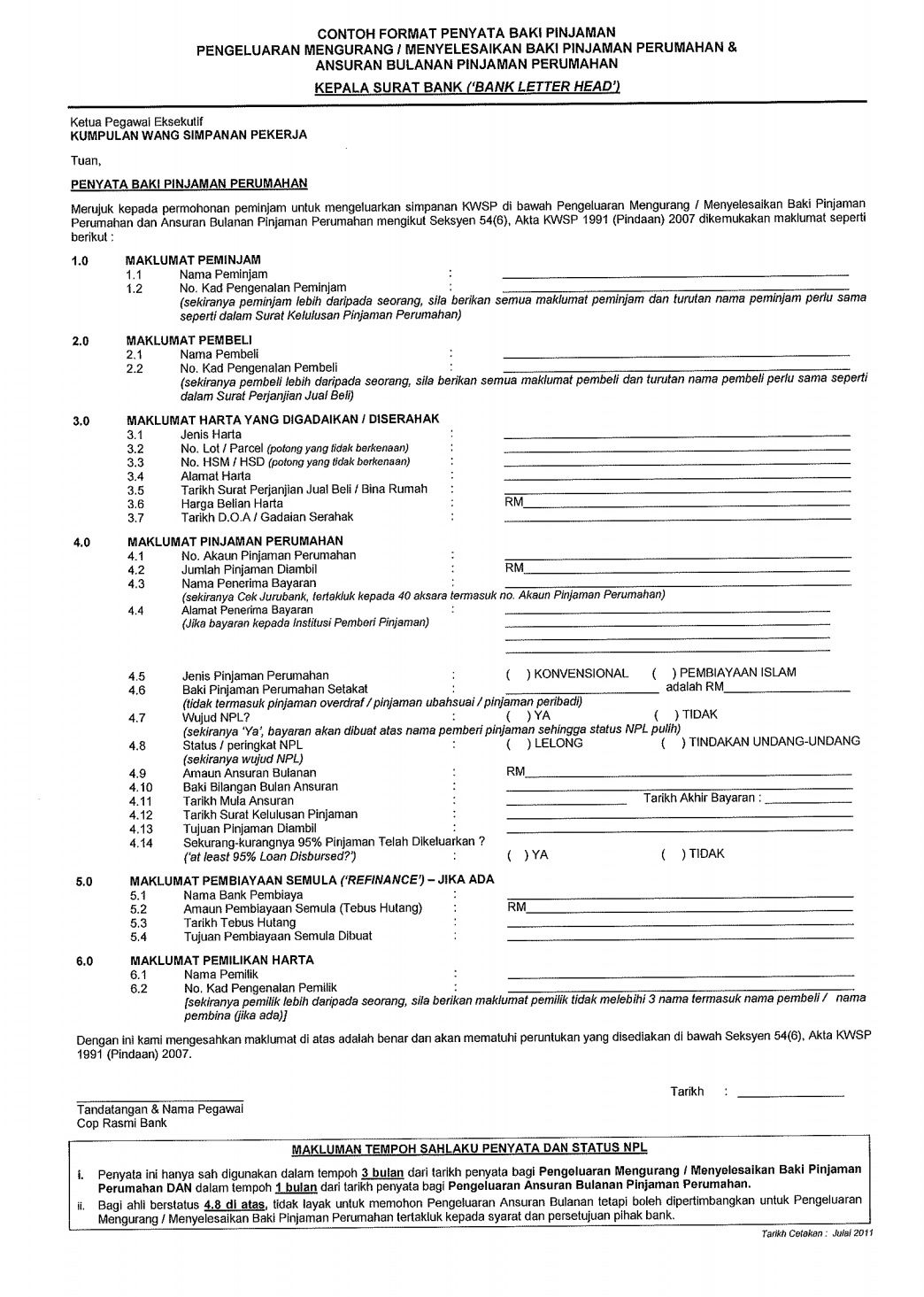

Kwsp Housing Loan Monthly Installment

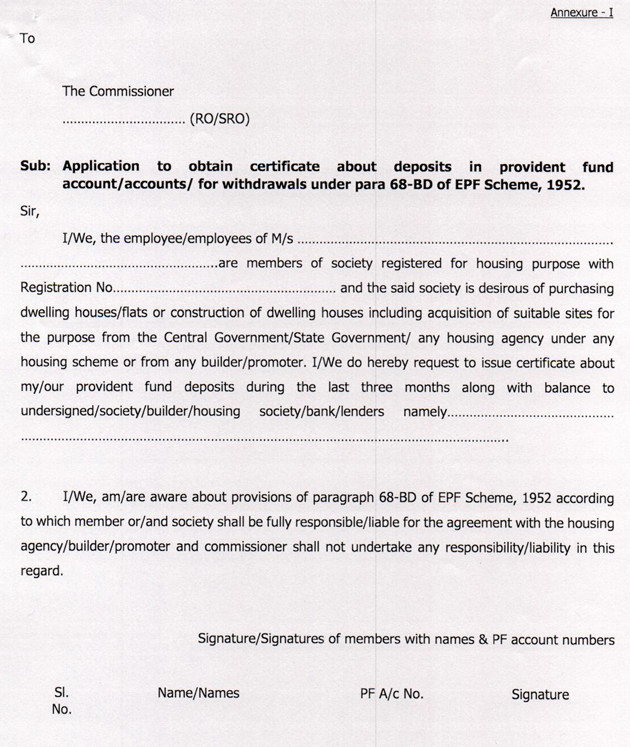

Login to the portal Visit the EPFO e-SEWA portal and login using your UAN and password and enter the captcha code.

How to withdraw epf for house installment. However if you are planning to migrate you may withdraw all the money in your EPF accounts. How Epf Can Reduce Your Home Loan Principal Or Monthly Installment Part 1 Black Belt Millionaire Epf Account 2 Withdrawal For House Installment Epf Withdrawals Mypf My. How to apply AdvancePartial PF Withdrawal onlineLink.

If you want to withdraw from EPF for repayment of housing loan you must have completed 10 years of service. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house. You can make a withdrawal to reducesettle your housing loan balance AND to pay your monthly housing loan instalment simultaneously.

One can withdraw from EPF account balance subject to certain conditions and within certain limits. They have 2 withdrawal methods. Here are the main amendments to EPF withdrawal rules-90 of the EPF balance can be withdrawn after the age of 54 years.

Since 1 January 2008 EPF aka. You can also withdraw epf for monthly home instalments. HttpsyoutubekoFqSPxHbMwFind our Whatsapp number in our Official Facebook page please Like and f.

The maximum you may withdraw under a zero-down home loan is 10 of the home price to help pay for entry costs and other fees. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. You can withdraw up to 90 of EPF balance employee share and contribution of employer including interest or the construction cost of property whichever is less.

The withdrawal is done through the From 31 form for EPF partial withdrawal. There are four options available and each carry a maximum withdrawal limit. Hence if you already availed this facility then you are not allowed to withdraw again.

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. You can withdraw up to 90 of the accumulated corpus for purchase of house or house site. This depends on the specifics of your purchase.

Purchasing a Home with a 100 Home Loan. Buying a Home as an Individual. EPF withdrawal for house flat or construction of property is allowed only once.

Complete 100 of EPF balance withdrawal gets. You should have completed three years of service. You cant withdraw to buy overseas properties.

Visit Online Claims section When youve logged in you can look for Claim Form-31 19 10C 10D in the Online Services section. Letter from bank for EPF withdrawal. In case youve forgotten your password you can reset via an OTP sent to your registered mobile number.

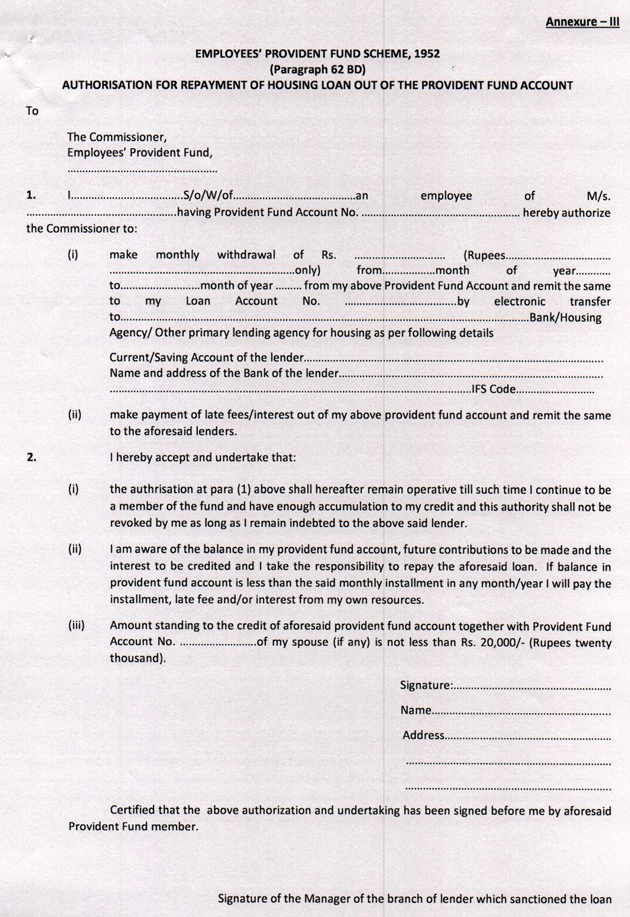

EPF Withdrawal before 5 years of Service. 75 of the EPF balance can get withdrawn if a person remains unemployed for one month. First is direct payment to your housing loan principal amount second is monthly payment to your housing loan bank account.

From the restrictions we can see that the EPFs withdrawal. The basics you ll need include filling out the withdrawal form kwsp 9c ahl d5 which can be done online or downloaded and filled manually a copy of your identification card and bank statement as well as the sale and purchase agreement for the property. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

Your accumulated EPF balance must be more than Rs20000. Unlike the withdrawal of EPF money to reduce housing loan which the money is directly made payable to the bank. An employee can prepay the home loan by withdrawing the PF amount.

You can avail this partial withdrawal facility only once in your life for housing purposes. For the withdrawal the employee should have reached at least 10 years of service. KWSP members are also allowed to withdraw their money from EPF Account II to pay for their monthly instalments of a housing loan which has been taken up for the purpose of buying or building a house.

After many years of withdrawal I personally find monthly installment not very beneficial compared. However this was for the first time only thereafter only letter from the bank was required. EPF reserves the right to cancel your monthly payment withdrawal if your loan has been fully settled your house has been soldauctionedits ownership transferred to another party or if you have been found guilty of fraud by submitting false.

Earlier also the rule was same. But that will be the extent of your withdrawal options for a home purchase.

Info How To Purchase A Property Using Your Epf Withdrawal Money Mymetrohartanah

Epf Withdrawal For Buying House And Paying Emi New Epfo Rule

Withdraw Epf Money For Home Loan Installment How It Affects Your Retirement Fund Kclau Com

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Epf Withdrawal For Housing Loan Epf Monthly Housing Instalment Withdrawal Which Form To Choose To Avail Housing Loan Somkisth

How Epf Can Reduce Your Home Loan Principal Or Monthly Installment Part 1 Black Belt Millionaire

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Epf Housing Scheme Here Is The Step By Step Process To Withdraw 90 Of Your Pf To Buy Home The Economic Times

Posting Komentar untuk "How To Withdraw Epf For House Installment"